Question

Assume that Blue Sunday Bank has $200 million of assets with an average duration of 1.6 years and liabilities of $100 million with an average

Assume that Blue Sunday Bank has $200 million of assets with an average duration of 1.6 years and liabilities of $100 million with an average duration of 1.95 years. Compute the current duration gap of this bank. Assuming that U.S. Treasury bonds with a duration of 1.2 years are currently quoted in the market at 98-16, explain the position (buy of sell) in a futures contract (including the number of contracts) that the bank manager should take to eliminate interest rate risk.

The following quotes will be used for the next two parts of this problem.

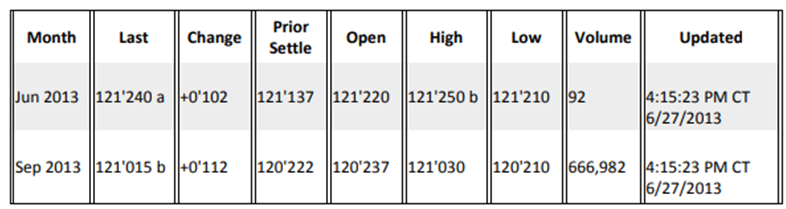

5-Year U.S. Treasury Bond Futures Contract Quotes from 6 / 27 / 2117

CBT $100,000; pts 32 nd of 100

Source: CME Group. (2013, June 27). 5-year U.S. Treasury note futures. Retrieved from http://www.cmegroup.com/trading/interest-rates/us-treasury/S-year-us-treasury-note_quotes_globex.htmIttprodType=AME

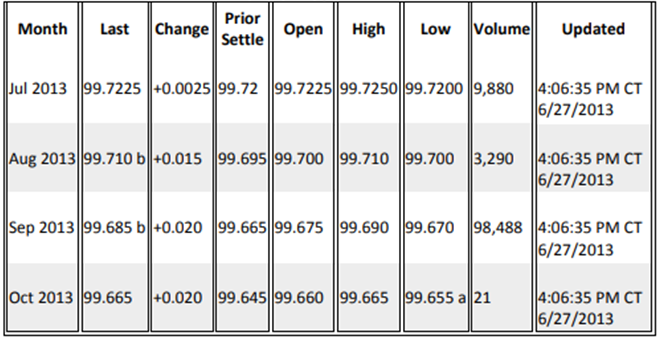

Eurodollar Future Contracts Quotes on 6/27/2013 CME - $100,000; pts of 100%

Source: CME Group. (2013, June 27). 5-year U.S. Treasury note futures. Retrieved from http://www.cmegroup.com/trading/interest-rates/us-treasury/S-year-us-treasury-note_quotes_globex.htmIttprodType=AME

Eurodollar Future Contracts Quotes on 6/27/2013 CME - $100,000; pts of 100%

Prior Settle Jun 2013 121'240 a +0'102 ||121137 ||121'220 ||121'250 b||121210 92 Month Last Change Sep 2013 121'015 b+0'112 Open High 120'222120'237121'030 Low Volume Updated 4:15:23 PM CT 6/27/2013 120'210666,982 4:15:23 PM CT 6/27/2013 Month Last Change Prior Settle Open High Low Volume Updated Jul 2013 99.7225 +0.0025 99.72 99.7225 99.7250 99.7200 9,880 4:06:35 PM CT 6/27/2013 Aug 2013 99.710 b +0.015 99.695 99.700 99.710 99.700 3,290 4:06:35 PM CT 6/27/2013 Sep 2013 99.685 b +0.020 99.665 99.675 99.690 99.670 98,488 4:06:35 PM CT 6/27/2013 Oct 2013 99.665 +0.020 99.645 99.660 99.665 99.655 a 21 4:06:35 PM CT 6/27/2013

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Current duration gap assets duration gaptotal assetstotal liabilies total assetsaverage duration of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started