Assume that Brave Pharmaceuticals acquired Tangent Therapeutics at the end of 2017. This acquisition was accomplished by paying a total of $900,000,000 in cash to

Assume that Brave Pharmaceuticals acquired Tangent Therapeutics at the end of 2017. This acquisition was accomplished by paying a total of $900,000,000 in cash to acquire all 10 million shares of Tangent's outstanding common stock from Tangent's shareholders. This purchase price of $90 per share represented a 40% premium over Tangent's share price immediately prior to the acquisition.

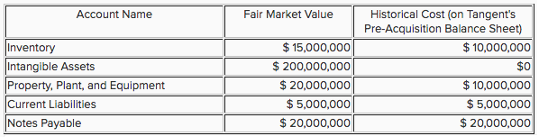

Below is information on the fair market value (at the time of the acquisition) and historical cost (as listed on Tangent's pre-acquisition balance sheet) for all of the separately identifiable assets and liabilities acquired from Tangent.

1. Calculate the amount of goodwill that would be recorded by Brave for this acquisition.

2. Suppose that Brave had a total of $1,300,000,000 in assets prior to their acquisition of Tangent. Calculate the total assets that would be reported by Brave after correctly recording their purchase of Tangent.

Account Name Inventory Intangible Assets Property, Plant, and Equipment Current Liabilities Notes Payable Fair Market Value $ 15,000,000 $ 200,000,000 $ 20,000,000 $5,000,000 $ 20,000,000 Historical Cost (on Tangent's Pre-Acquisition Balance Sheet) $10,000,000 $0 $ 10,000,000 $5,000,000 $ 20,000,000

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Computation of Goodwill Goodwill is the excess payment made over the f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started