Question

Assume that you recently graduated and landed a job as a financial planner with Cicero Services, an investment advisory company. The Client presently owns a

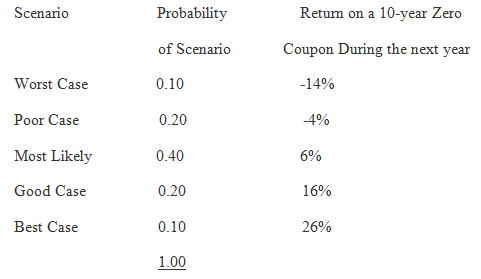

Assume that you recently graduated and landed a job as a financial planner with Cicero Services, an investment advisory company. The Client presently owns a bond portfolio with $1 million invested in zero coupon Treasury bonds that mature in 10 years. (The total par value at maturity is $1.79 million and yield to maturity is about 6%, but that information is not necessary for the mini case.) You have calculated the rate of return on 10-year zero coupon for each scenario.

The Risk Free Rate is 4% and the market risk premium is 5%

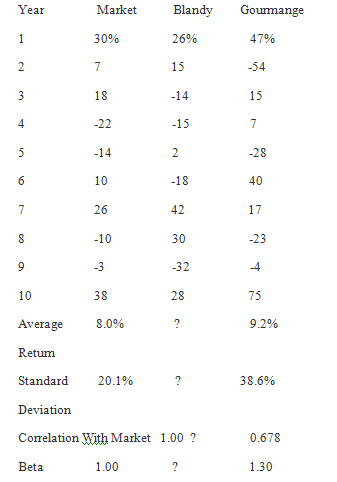

You client has decided that the risk of the bond portfolio is acceptable and wishes to leave it as it is. Now your client has asked you to use historical returns to estimate the standard deviation of Blandy?s stock returns. (Use Blandy?s 10 annual returns)

Scenario Worst Case Poor Case Most Likely Good Case Best Case Probability of Scenario 0.10 0.20 0.40 0.20 0.10 1.00 Return on a 10-year Zero Coupon During the next year -14% -4% 6% 16% 26% Year 1 2 4 5 6 7 8 9 10 Average Retur Market Beta 30% 7 18 -22 -14 10 26 -10 -3 38 8.0% 20.1% Blandy 26% 15 1.00 -14 -15 2 -18 42 30 -32 Standard Deviation Correlation With Market 1.00 ? 28 ? ? ? Gourmange 47% -54 15 7 -28 40 17 -23 -4 75 9.2% 38.6% 0.678 1.30

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started