Question

Assume the Fed buys a bond from a US bank for $1000, this becomes excess reserves for the bank and get loaned out, since we

Assume the Fed buys a bond from a US bank for $1000, this becomes excess reserves for the bank and get loaned out, since we will assume banks do not hold on to excess reserves.

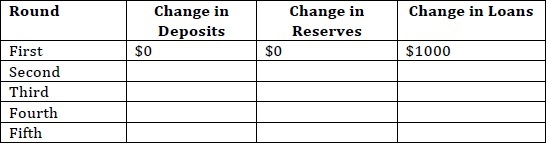

Suppose that all banks have a desired reserve ratio of 20%. The following table shows how deposits, reserves, and loans enable the creation of money.

A. Complete the table below:

B. After 5 rounds, what is the total change in deposits as a result of the single NEW deposit?

C. What is the eventual total change in deposits?

D. What is the eventual total change in the money supply?

E. Assume that the Federal Reserve implements a new law that sets a required reserve ratio equal to 30%. How would this have changed your answers to parts C and D.

Round First Second Third Fourth Fifth $0 Change in Deposits $0 Change in Reserves Change in Loans $1000

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A Deposits Reserves Loans 1st 1000 2nd 1000 200 800 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started