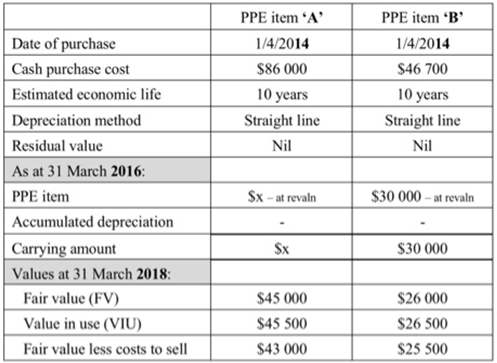

At 31 March 2018, Dextor Ltd provided you with information regarding two of their property, plant and equipment (PPE) items: If applicable, in the journal

At 31 March 2018, Dextor Ltd provided you with information regarding two of their property, plant and equipment (PPE) items:

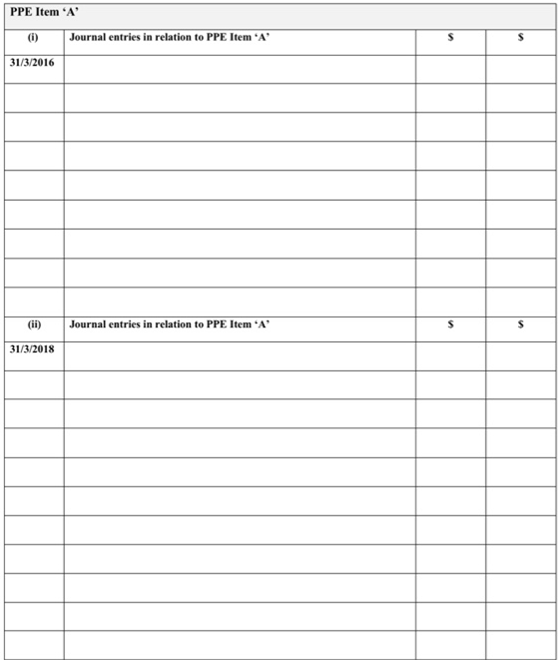

If applicable, in the journal entries below for both 'A' and 'B', provide details of where the revaluation gain/loss will be shown in the Comprehensive Income Statement and which equity account the gain/loss will be closed off to i.e. P or IJREs or OCl/ARS.

Required:

In relation to PPE item 'A':

(i) At 31 March 2016, Dextor Ltd changed to the revaluation model for this item, and a revaluation gain of $11 200 was recognized. Prepare the journal entries at 31 March 2016 to record the first revaluation for PPE item 'A'. Show all your workings within the journal entries. (ii) At 31 March 2018 the PPE item 'A' was to be revalued to its FV of $45 000. Prepare the necessary journal entries at 31 March 2018 to record the second revaluation. Show all your workings within the journal entries.

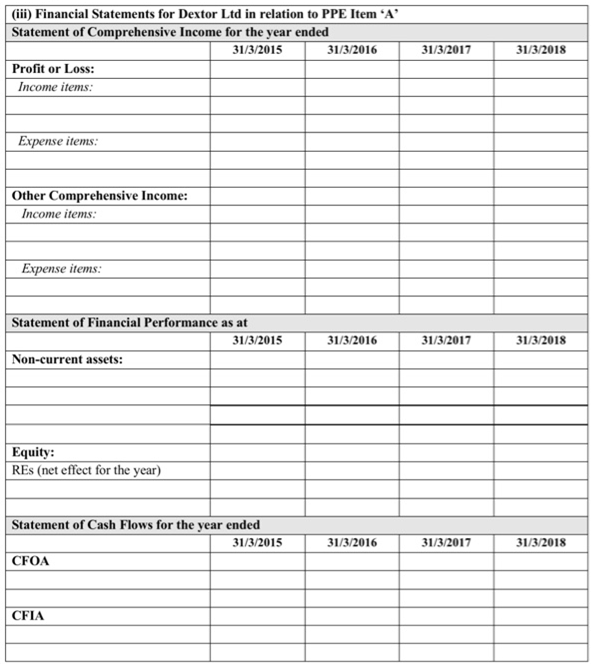

(iii) Prepare extracts from the financial statements for Dexter Ltd in relation to PPE item ?A' for the years ended 31 March 2015, 2016, 2017 and 2018. (iv) The PPE item ?A? is sold for $40 000 cash on 31 December 2018. Prepare the necessary journal entries to record the disposal.

Required in relation to PPR item ?B?:

(i) At 31 March 2016 Dcxtor Ltd changed to the revaluation model for this item. The PPE item ?B' was revalued to its FV $30 000. Prepare the journal entries at 31 March 2016 to record the first revaluation. Show all your workings within the journal entries.

(ii) At 31 March 2018 the PPF. item ?B? was to be revalued to its FV of $26 000. Prepare the necessary journal entries at 31 March 2018 to record the second revaluation for this PPE item ?B?. Show all your workings within the journal entries.

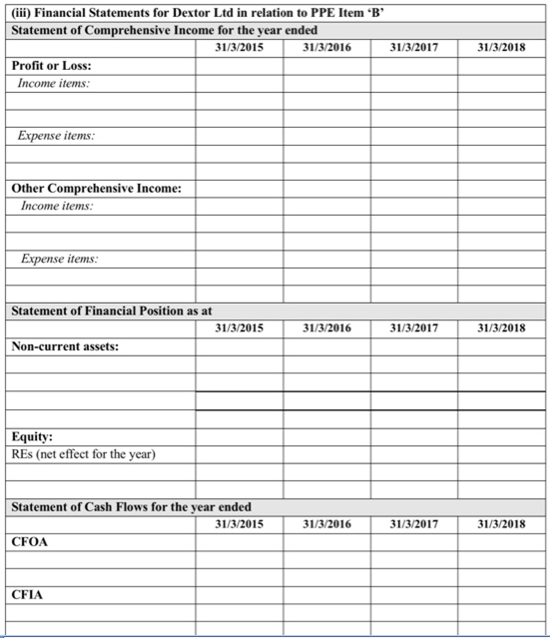

(iii) Assume Dcxtor Ltd uses the cost model for PPE item ?B? and the item is not impaired for the purposes of Question 3. Show extracts from the financial statements for Dcxtor Ltd in relation to PPE item ?B? for the years ended 31 March 2015. 2016. 2017 and 2018.

Date of purchase Cash purchase cost Estimated economic life Depreciation method Residual value As at 31 March 2016: PPE item Accumulated depreciation Carrying amount Values at 31 March 2018: Fair value (FV) Value in use (VIU) Fair value less costs to sell PPE item 'A' 1/4/2014 $86 000 10 years Straight line Nil Sx-at revaln Sx $45 000 $45 500 $43 000 PPE item 'B' 1/4/2014 $46 700 10 years Straight line Nil $30 000-at revaln $30 000 $26 000 $26 500 $25 500 PPE Item 'A' (i) 31/3/2016 (ii) 31/3/2018 Journal entries in relation to PPE Item 'A' Journal entries in relation to PPE Item 'A' S S (iii) Financial Statements for Dextor Ltd in relation to PPE Item 'A' Statement of Comprehensive Income for the year ended 31/3/2015 Profit or Loss: Income items: Expense items: Other Comprehensive Income: Income items: Expense items: Statement of Financial Performance as at Non-current assets: Equity: REs (net effect for the year) Statement of Cash Flows for the year ended 31/3/2015 CFOA 31/3/2015 CFIA 31/3/2016 31/3/2016 31/3/2016 31/3/2017 31/3/2017 31/3/2017 31/3/2018 31/3/2018 31/3/2018 (iii) Financial Statements for Dextor Ltd in relation to PPE Item 'B' Statement of Comprehensive Income for the year ended 31/3/2015 Profit or Loss: Income items: Expense items: Other Comprehensive Income: Income items: Expense items: Statement of Financial Position as at Non-current assets: Equity: REs (net effect for the year) Statement of Cash Flows for the year ended 31/3/2015 CFOA 31/3/2015 CFIA 31/3/2016 31/3/2016 31/3/2016 31/3/2017 31/3/2017 31/3/2017 31/3/2018 31/3/2018 31/3/2018

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

PPE item A Date Particular Amount Amount i 3132016 PPE item A Dr 11200 Revaluation Surplus Cr 11200 Recording revaluation gain 3132016 Depreciation Ex...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started