Question

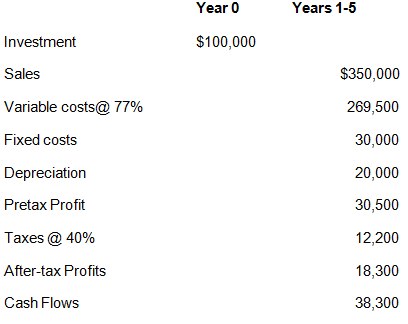

At Macrohard, Inc. the cost of secret project X is $100,000. According to a confidential management report, the following can be expected in each of

At Macrohard, Inc. the cost of secret project X is $100,000. According to a confidential management report, the following can be expected in each of the five years of the machine?s life.

Assume the cost of capital is 10%.

NPV = $45,187

a. What if the price of the machine turns out to be $120,000 instead of $100,000 (assume straight line depreciation)? What happens to net present value?

b) Instead, what if the economy booms and sales come in at $450,000 per year (variable costs remain at 77% of sales)? What happens to net present value?

c) Calculate the accounting break-even level of sales:

d) Calculate the break?even level of sales in units if the price per unit is $35:

e) Assume that a rival (Gill Bates, Inc.) is working on a similar project. If they can develop their product, you project that your sales estimate will be 10% lower than originally thought and that your variable costs will rise to 78.5% of sales due to higher promotional costs. Should you go ahead with the project?Investment Sales Variable costs@ 77% Fixed costs Depreciation Pretax Profit Taxes @ 40% After-tax Profits Cash Flows Year 0 $100,000 Years 1-5 $350,000 269,500 30,000 20,000 30,500 12,200 18,300 38,300

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Year 0 Years 15 Cash Flows Investment 100000 120000 Sales 350000 35000 Variable costs 77 269500 26...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started