Answered step by step

Verified Expert Solution

Question

1 Approved Answer

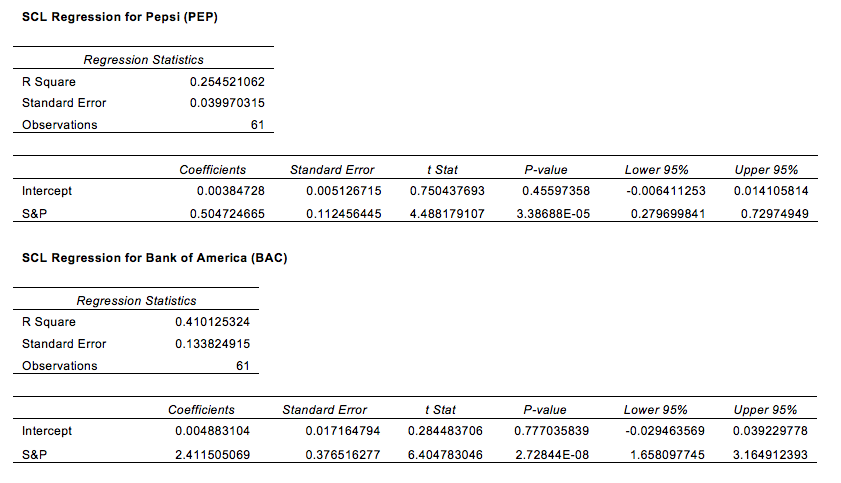

(a)What is the alpha and beta for Pepsi (PEP) and Bank of America (BAC)? Explain. (b)Are either PEP or BAC mispriced? Explain. (c)Assume the standard

(a)What is the alpha and beta for Pepsi (PEP) and Bank of America (BAC)? Explain.

(b)Are either PEP or BAC mispriced? Explain.

(c)Assume the standard deviation of the market portfolio is 15%. Does PEP or BAC have a higher variance?

(d)?A higher fraction of PEP?s variance is due to unsystematic risk.? Is this statement true or false? Explain.

SCL Regression for Pepsi (PEP) R Square Standard Error Observations Intercept S&P Regression Statistics Intercept S&P 0.254521062 0.039970315 R Square Standard Error Observations Coefficients SCL Regression for Bank of America (BAC) 61 0.00384728 0.504724665 Regression Statistics 0.410125324 0.133824915 61 Coefficients 0.004883104 2.411505069 Standard Error t Stat 0.005126715 0.750437693 0.112456445 4.488179107 t Stat 0.017164794 0.284483706 0.376516277 6.404783046 Standard Error P-value 0.45597358 3.38688E-05 P-value 0.777035839 2.72844E-08 Lower 95% -0.006411253 0.279699841 Upper 95% 0.014105814 0.72974949 Lower 95% Upper 95% 0.039229778 -0.029463569 1.658097745 3.164912393

Step by Step Solution

★★★★★

3.59 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a The alpha for PEP is 000385 and beta for PEP is 05047 The value of alpha means if SP is not consid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60965de13fb6f_26825.pdf

180 KBs PDF File

60965de13fb6f_26825.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started