Answered step by step

Verified Expert Solution

Question

1 Approved Answer

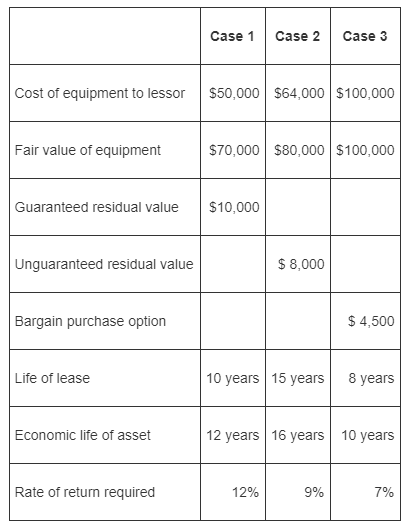

Below are three independent lease scenarios. Payments are made at the end of each year. Required: 1. Calculate the lease payments for the above three

Below are three independent lease scenarios. Payments are made at the end of each year.

Required:

1. Calculate the lease payments for the above three cases.

2. Based on the relation between the lease life and economic life, the lessees will classify the leases as capital leases. For each lease, compute the lessee's depreciation expense for the first year of the lease. Assume the use of the straight-line method and no salvage value at the end of the economic life.

Cost of equipment to lessor Fair value of equipment Guaranteed residual value Unguaranteed residual value Bargain purchase option Life of lease Economic life of asset Rate of return required Case 1 Case 2 $50,000 $64,000 $100,000 $10,000 $70,000 $80,000 $100,000 $ 8,000 10 years 15 years 12% 12 years 16 year Case 3 9% $ 4,500 8 years 10 years 7%

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Part1 Lease ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6099cbbbf0302_30041.pdf

180 KBs PDF File

6099cbbbf0302_30041.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started