Question

Building One Properties is a limited partnership formed with the express purpose of investing in commercial real estate. The firm is currently considering the acquisition

Building One Properties is a limited partnership formed with the express purpose of investing in commercial real estate. The firm is currently considering the acquisition of an office building that we refer to simply as Building B. Building B is very similar to Building A, which recently sold for $36,960,000.

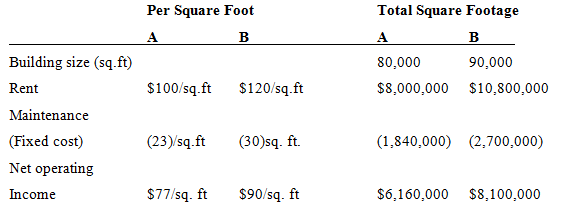

Building One has gathered general information about the two buildings, including valuation information for Building A:

Building A & B are similar in size (80,000 and 90,000 square feet respectively). However, the two buildings differ both in maintenance costs ($23 and $30 per square foot) and rental rates ($100 versus $120 per square foot). At this point, we do not know why these differences exist. Nonetheless, the differences are real and should somehow be ?accounted for? in the analysis of the value of Building B using data based on the sale of Building A.

Building A sold for $462 per square foot, or $36,960,000. This reflects a sales multiple of six times the building?s net operating income (NOI) of $6,160,000 per year and a capitalization rate of 16.67%.

(a) Using the multiple of operating income, determine what value Building One should place on Building B.

(b) If the risk-free rate of interest is 5.5% and the building maintenance costs are known with a high degree of certainty, what value should Building One place on Building B?s maintenance costs? How much value should Building One place Building B?s revenues and, consequently, on the firm?

Building size (sq.ft) Rent Maintenance (Fixed cost) Net operating Income Per Square Foot A B $100/sq.ft (23)/sq.ft $77/sq. ft $120/sq.ft (30)sq. ft. $90/sq. ft Total Square Footage A B 80,000 90,000 $8,000,000 $10,800,000 (1,840,000) (2,700,000) $6,160,000 $8,100,000

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Per Square Feet Total Square Feet A B A B Building Size 80000 90000 80000 90000 Rent 100 120 100 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started