Question

Burke Ltd. began operations in February 2008 with 4,500 units of inventory that it purchased at a cost of $12.00 each. The company?s purchases during

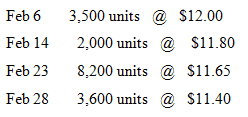

Burke Ltd. began operations in February 2008 with 4,500 units of inventory that it purchased at a cost of $12.00 each. The company?s purchases during February were as follows:

Sales during February:

Feb 4?????.1,500 units

Feb 15?????5,800 units

Feb 24?????7,200 units

Burke uses a periodic inventory system.

Required:

a. Calculate the cost of goods sold for February using the weighted average cost flow assumption.

b. Calculate the cost of goods sold for February using the first-in, first-out cost flow assumption.

c. Which inventory cost flow assumption results in the greater net income for February? Which results in the smaller?

d. Which inventory cost flow assumption results in the larger inventory balance at the end of February? Which results in the smaller?

Feb 6 Feb 14 Feb 23 Feb 28 3,500 units @ $12.00 2,000 units @ $11.80 8,200 units @ $11.65 3,600 units @ $11.40

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Weighted average cost per unit units per unit total beginning invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started