Answered step by step

Verified Expert Solution

Question

1 Approved Answer

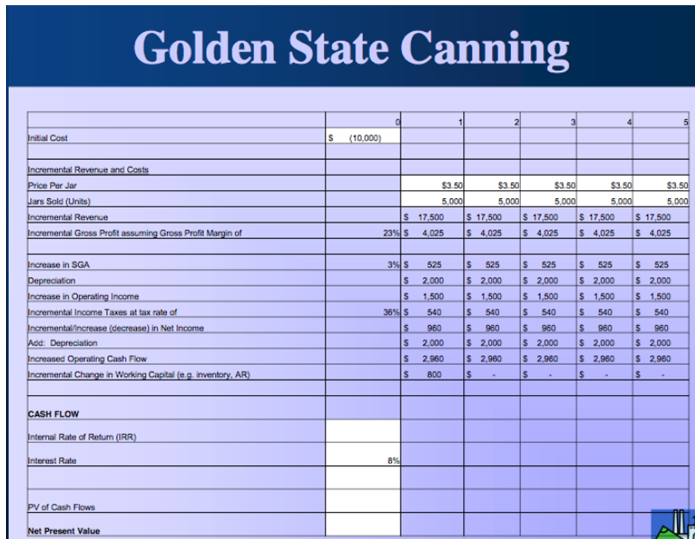

Calculate annual projected cash flows for year 0-5 for Jarring project Initial Cost Incremental Revenue and Costs Price Per Jar Jars Sold (Units) Incremental Revenue

Calculate annual projected cash flows for year 0-5 for Jarring project

Initial Cost Incremental Revenue and Costs Price Per Jar Jars Sold (Units) Incremental Revenue Incremental Gross Profit assuming Gross Profit Margin of Golden State Canning Increase in SGA Depreciation Increase in Operating Income Incremental Income Taxes at tax rate of Incremental/Increase (decrease) in Net Income Add: Depreciation Increased Operating Cash Flow Incremental Change in Working Capital (e.g. inventory, AR) CASH FLOW Internal Rate of Return (IRR) Interest Rate PV of Cash Flows Net Present Value S (10,000) $ 23% $ 3% S $ $ 36% $ 8% $3.50 5,000 17,500 4,025 525 2,000 1,500 540 960 2,000 2,960 $3.50 5,000 $ 17,500 $ 4,025 S 525 $ 2,000 $ 1,500 $ 540 $ 960 $ 2,000 $ $ $ $ 800 $ $ 2,960 $3.50 5,000 $ 17,500 $ 4,025 $ 525 $ 2,000 $ 1,500 $ 540 $ 960 $ 2,000 $ 2,960 $ . $3.50 5.000 $ 17,500 $ 4,025 $ 525 $ 2,000 $1,500 $ 540 $ 960 $ 2,000 $ 2,960 $ $3.50 5.000 $ 17,500 $ 4,025 $ 525 $ 2,000 $ 1,500 $ 540 $ 960 $ 2,000 $ 2,960 $

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Table 1 Cash f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60981b324c4d9_28506.pdf

180 KBs PDF File

60981b324c4d9_28506.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started