Question

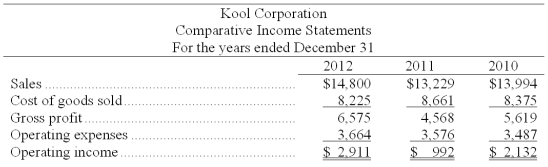

Comparative statements for Kool Corporation are shown below: Calculate trend percentages for all income statement amounts shown and comment on the results. Use 2010 as

Comparative statements for Kool Corporation are shown below:

Calculate trend percentages for all income statement amounts shown and comment on the results. Use 2010 as the base year. Comment on the results.

Sales. Cost of goods sold. Gross profit. Operating expenses Operating income Kool Corporation Comparative Income Statements For the years ended December 31 2012 $14,800 8,225 6,575 3,664 $ 2,911 2011 $13,229 8,661 4,568 3,576 992 2010 $13,994 8,375 5,619 3.487 $ 2.132

Step by Step Solution

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Horngren 2012 asserts to the reality that when computing the trend percentages for the two fiscal periods the base year will remain unchanged In all t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistical Techniques In Business And Economics

Authors: Douglas Lind, William Marchal, Samuel Wathen

18th Edition

1260239470, 978-1260239478

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App