Question

Compare effects of the inventory cost-flow assumptions FIFO and LIFO on the financial statements. Compare effects of the depreciation method (SL or DDB) on the

- Compare effects of the inventory cost-flow assumptions FIFO and LIFO on the financial statements. Compare effects of the depreciation method (SL or DDB) on the financial statements.

- Prepare the income statement. balance sheet. and the statement of cash flows using different accounting methods

- Understand how the choice of different accounting methods affects cash and accrual accounting.

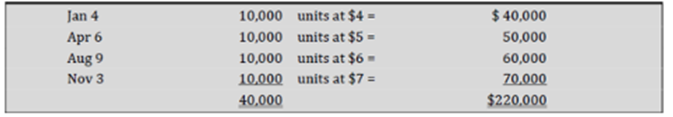

Frasco and Lasco are virtually identical: both companies began operations at the beginning of the current year and during the year purchased inventory as follows:

During the first year. both companies sold 25,000 units of inventory. Fiasco uses the first-in. first-out (FIFO) method. and Lasco uses last-in. first-out (LIFO) method for inventory.

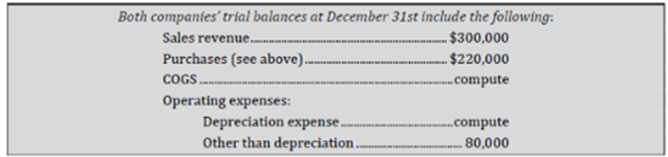

In early January both companies purchased equipment costing $200,000 with a 10-year estimated useful life and no residual value. Fiasco uses straight-line depreciation. and Lasco uses double-declining-balance depreciation for equipment.

Use the above information to answer the following questions.

1. Prepare a multi-step Income Statement for both companies in the space provided below.

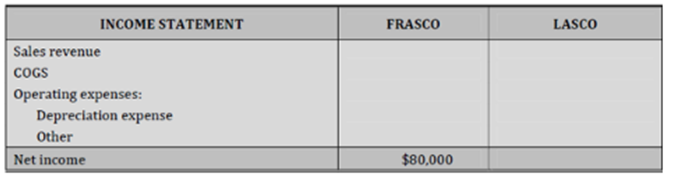

2. Assuming all transactions are cash transactions, prepare a statement of Cash Flows. Also prepare the Supplement Schedule ? Indirect Method that reconciles net income and net cash from operating activities.

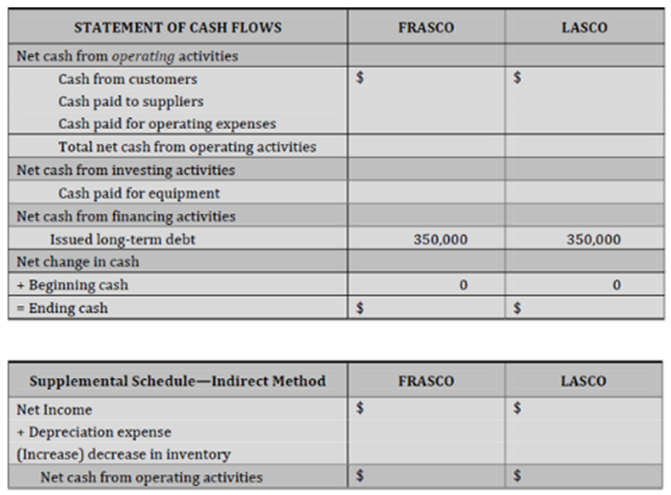

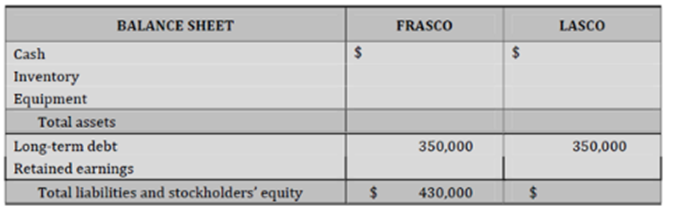

3. Prepare a Balance Sheet for both companies in the space provided below.

4.

a. Which company appears to be more profitable? (Frasco / Lasco / the same).

b. Which company generated more cash during the year? (Frasco I Lasco / the same) .

c. Which company presents a stronger balance sheet? (Frasco / Lasco I the same) Why? 5. On the Income Statement, why is net income different for Frasco and Lasco?

6. On the balance sheet, which accounts report different amounts? (Cash / Inventory / Equipment / Notes payable / Retained earnings) Why?

7. On the Statement of Cash Flows, which totals differ between Frasco and Lasco? Net cash from (operating / investing I financing 1 none) What conclusions can you draw from this Activity?

8. Different accounting methods, such as FIFO or LIFO and SL or DDB. affect (cash- / accrual-) basis accounting.

Jan 4 Apr 6 Aug 9 Nov 3 10,000 units at $4= 10,000 units at $5= 10,000 units at $6 = 10,000 units at $7 = 40,000 $ 40,000 50,000 60,000 70,000 $220,000 Both companies' trial balances at December 31st include the following: Sales revenue------ Purchases (see above).. ----$300,000 .$220,000 COGS ...compute Operating expenses: Depreciation expense. Other than depreciation.. ..compute 80,000 INCOME STATEMENT Sales revenue COGS Operating expenses: Depreciation expense Other Net income FRASCO $80,000 LASCO STATEMENT OF CASH FLOWS Net cash from operating activities Cash from customers Cash paid to suppliers Cash paid for operating expenses Total net cash from operating activities Net cash from investing activities Cash paid for equipment Net cash from financing activities Issued long-term debt Net change in cash + Beginning cash Ending cash Supplemental Schedule-Indirect Method Net Income + Depreciation expense (Increase) decrease in inventory Net cash from operating activities $ $ $ $ FRASCO 350,000 FRASCO 0 $ $ $ $ LASCO 350,000 LASCO 0 Cash Inventory Equipment Total assets BALANCE SHEET Long-term debt Retained earnings Total liabilities and stockholders' equity $ $ FRASCO 350,000 430,000 $ $ LASCO 350,000

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the income statement of Company F under first in firstout It is given that the sales revenue is 300000 and the other expenses are 80000 The cost of goods sold is 120000 and the depreciatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started