Question

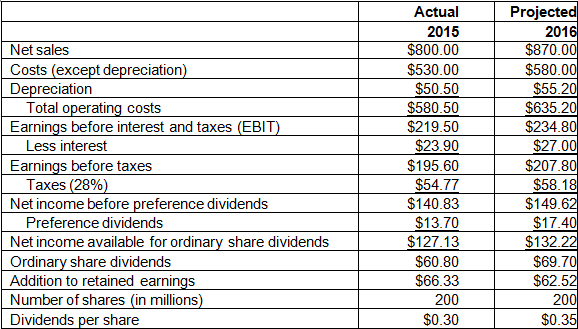

Consider the financial statements of Apocalypse Limited below. Income Statements for the Year Ending December 31 (Millions of Dollars Except for Per Share Data) Using

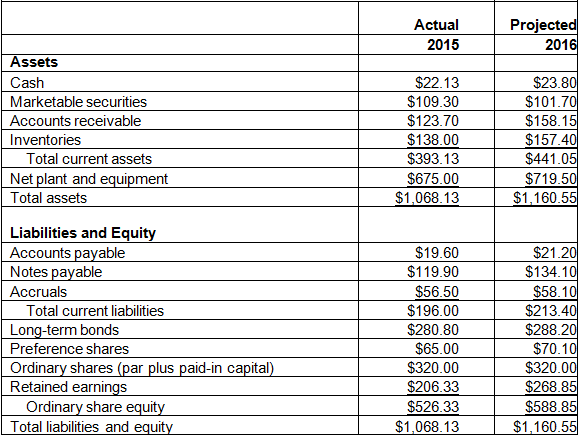

Consider the financial statements of Apocalypse Limited below.

Income Statements for the Year Ending December 31 (Millions of Dollars Except for Per Share Data)

Using the information provided, you are required to answer the following questions:

a) The company?s tax rate is 28%. What is the company?s free cash flow at the end of 2016? Show your calculations.

b) How is the company planning to use its free cash flow in 2016? Show your calculations.

c) What is the company?s return on invested capital in 2016? Suppose the company has a 10% weighted average cost of capital. Do you think the company?s growth added value? Support your answer with calculations and explanation.

d) Explain the difference between NOPAT and net income. Which is a better measure of the performance of a company?s operations? Why?

Net sales Costs (except depreciation) Depreciation Total operating costs Earnings before interest and taxes (EBIT) Less interest Earnings before taxes Taxes (28%) Net income before preference dividends Preference dividends Net income available for ordinary share dividends Ordinary share dividends Addition to retained earnings Number of shares (in millions) Dividends per share Actual 2015 $800.00 $530.00 $50.50 $580.50 $219.50 $23.90 $195.60 $54.77 $140.83 $13.70 $127.13 $60.80 $66.33 200 $0.30 Projected 2016 $870.00 $580.00 $55.20 $635.20 $234.80 $27.00 $207.80 $58.18 $149.62 $17.40 $132.22 $69.70 $62.52 200 $0.35 Assets Cash Marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Preference shares Ordinary shares (par plus paid-in capital) Retained earnings Ordinary share equity Total liabilities and equity Actual 2015 $22.13 $109.30 $123.70 $138.00 $393.13 $675.00 $1,068.13 $19.60 $119.90 $56.50 $196.00 $280.80 $65.00 $320.00 $206.33 $526.33 $1,068.13 Projected 2016 $23.80 $101.70 $158.15 $157.40 $441.05 $719.50 $1,160.55 $21.20 $134.10 $58.10 $213.40 $288.20 $70.10 $320.00 $268.85 $588.85 $1,160.55

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Free cash flow operating cash flowcapital expenditures FCF 63520X128100580X1281...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started