Question

Cowboy Luke, a publicly listed London based company, has specialized equipment which makes wooden rocking horses. All British publicly listed companies are required to use

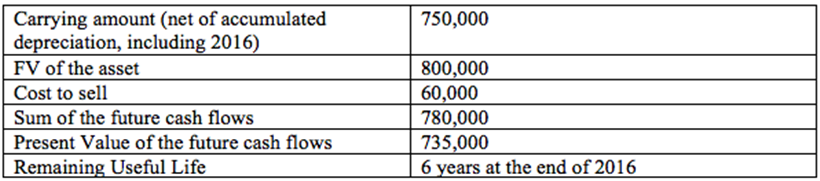

Cowboy Luke, a publicly listed London based company, has specialized equipment which makes wooden rocking horses. All British publicly listed companies are required to use 'FRS. Their financial year ends on 12/31. At the end of 2016, the equipment has the following characteristics:

It is depreciated using the straight line method. Assume there is no residual value.

It is depreciated using the straight line method. Assume there is no residual value.

1. Calculate the recoverable amount. (5 points) 2. Determine if there is an impairment of this asset. (5 points) 3. Write the journal entry (if there is one). If not, tell me there is no journal entry. (5 points)

Carrying amount (net of accumulated depreciation, including 2016) FV of the asset Cost to sell Sum of the future cash flows Present Value of the future cash flows Remaining Useful Life 750,000 800,000 60,000 780,000 735,000 6 years at the end of 2016

Step by Step Solution

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Using Financial Accounting Information The Alternative to Debits and Credits

Authors: Gary A. Porter, Curtis L. Norton

7th Edition

978-0-538-4527, 0-538-45274-9, 978-1133161646

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App