Question

Create an application that the Martin Company's accountant can used to calculate an asset's annual depreciation. You can either create your own interface. The figure

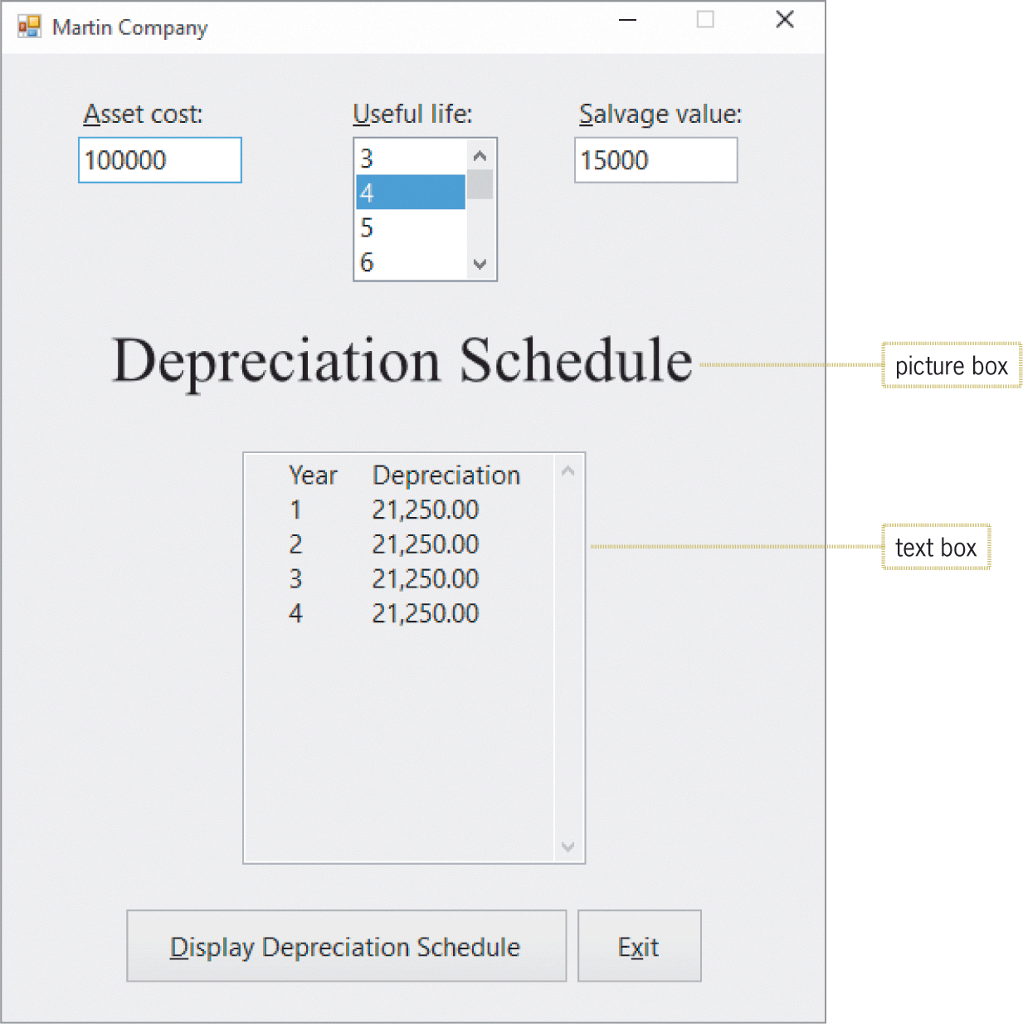

Create an application that the Martin Company's accountant can used to calculate an asset's annual depreciation. You can either create your own interface. The figure shows a sample depreciation schedule for an asset with a cost of $100,000, a useful life of four years, and a salvage value of $15,000. The accountant will enter the asset's cost, useful life (in years), and salvage value (which is the value of the asset at the end of its useful life). Use a list box to allow the user to select the useful life. Display the line depreciation amounts using the Financial.SLN method. (SLN stands for straight-line.) The method's syntax is Financial. SLN(cost, salvage, life), in which cost, salvage, and life are the asset's cost, salvage value, and useful life, respectively. The method returns the depreciation amount as a Double number. The Asset cost and Salvage value text boxes shown in Figure 6-59 should accept only numbers, the period, and the Backspace key. The Depreciation Schedule image in the picture box also is attached above. Click the Exit button and then close the solution. Zip the project folder into a single zip file and submit it to the form inside this folder.

Martin Company Asset cost: 100000 Useful life: 3 14 5 6 Depreciation Schedule Year Depreciation 1 21,250.00 2 21,250.00 3 21,250.00 4 21,250.00 Salvage value: 15000 Display Depreciation Schedule Exit X picture box text box

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Function to calculate Depreciation Value for Each year is as below See detailed comments to understa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609387d8682cf_23898.pdf

180 KBs PDF File

609387d8682cf_23898.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started