Question

Crosley Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2014. The lease is for an 10-year period and requires equal

Crosley Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2014. The lease is for an 10-year period and requires equal annual payments of $34,177 at the beginning of each year. The first payment is received on January 1, 2014. Crosley had purchased the machine during 2013 for $164,000. Collectibility of lease payments is reasonably predictable, and no important uncertainties surround the amount of costs yet to be incurred by Crosley. Crosley set the annual rental to ensure an 10% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Crosley at the termination of the lease.

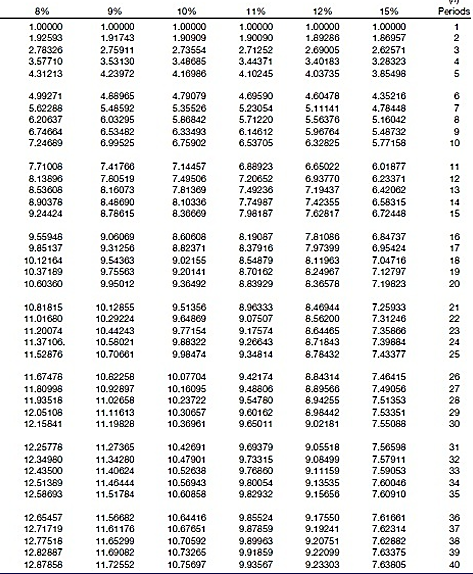

TABLE 6-5 PRESENT VALUE OF AN ANNUITY DUE OF 1:

Compute the amount of the lease receivable.

| The amount of the lease receivable | $ |

Prepare all necessary journal entries for Crosley for 2014.

| Date | Account Titles & Explanation | Debit | Credit |

| 1/1/14 | |||

| 12/31/14 | |||

8% 1.00000 1.92593 2.78326 3.57710 4.31213 4.99271 5.62268 6.20637 6.74664 7.24669 7.71008 8.13896 8.53606 8.90378 9.24424 9.55946 9.85137 10.12164 10.37189 10.60360 10.81815 11.01680 11.20074 11.37106. 11.52876 11.67478 11.80996 11.93518 12.05108 12.15841 12.25778 12.34960 12.43500 12.51369 12.58693 12.65457 12.71719 12.77518 12.82887 12.87858 9% 1.00000 1.91743 2.75911 3.53130 4.23972 4.68965 5.48592 6.03295 6.53482 6.99525 7.41766 7.60519 8.16073 8.48090 8.78615 9.06069 9.31256 9.54363 9.75563 9.95012 10.12855 10.29224 10.44243 10.58021 10.70661 10.82258 10.92897 11.02658 11.11613 11.19828 11.27365 11.34280 11.40624 11.46444 11.51784 11.56682 11.61176 11.65299 11.69082 11.72552 10% 1.00000 1.90909 2.73554 3.48685 4.16986 4.79079 5.35526 5.86842 6.33493 6.75902 7.14457 7.49506 7.81369 8.10336 8.36669 8.60608 8.82371 9.02155 9.20141 9.36492 9.51356 9.64869 9.77154 9.88322 9.98474 10.07704 10.16095 10.23722 10.30667 10.36961 10.42691 10.47901 10.52638 10.56943 10.60858 10.64416 10.67651 10.70592 10.73265 10.75697 11% 1.00000 1.90090 2.71252 3.44371 4.10245 4.69590 5.23054 5.71220 6.14612 6.53705 6.88923 7.20652 7.49236 7.74987 7.98187 8.19087 8.37916 8.54879 8.70162 8.83929 8.96333 9.07507 9.17574 9.26643 9.34814 9.42174 9.48806 9.54780 9.60162 9.65011 9.69379 9.73315 9.76860 9.80054 9.82932 9.85524 9.87859 9.89963 9.91859 9.93567 12% 1.00000 1.89286 2.69005 3.40183 4.03735 4.60478 5.11141 5.56376 5.96764 6.32825 6.65022 6.93770 7.19437 7.42355 7.62817 7.81086 7.97399 8.11963 8.24967 6.36578 8.46944 8.56200 6.64465 8.71843 8.78432 8.84314 8.89566 8.94255 8.98442 9.02181 9.05518 9.08499 9.11159 9.13535 9.15656 9.17550 9.19241 9.20751 9.22099 9.23303 15% 1.00000 1.86957 2.62571 3.28323 3.85498 4.35216 4.78448 5.16042 5.48732 5.77158 6.01877 6.23371 6.42062 6.58315 6.72448 6.84737 6.95424 7.04716 7.12797 7.19823 7.25933 7.31246 7.35866 7.39884 7.43377 7.46415 7.49056 7.51353 7.53351 7.55088 7.56598 7.57911 7.59053 7.60046 7,60910 7.61661 7.62314 7.62882 7.63375 7.63805 Periods 12345 67899 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 40

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The amount of the lease receivable 34177675902 231003 b Date A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

608fd47795c0e_21311.pdf

180 KBs PDF File

608fd47795c0e_21311.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started