Question

Cruise Industries purchased $10,800 of merchandise on February 1, 2014, subject to a trade discount of 9% and with credit terms of 3/15, n/60. It

Cruise Industries purchased $10,800 of merchandise on February 1, 2014, subject to a trade discount of 9% and with credit terms of 3/15, n/60. It returned $3,500 (gross price before trade or cash discount) on February 4. The invoice was paid on February 13.

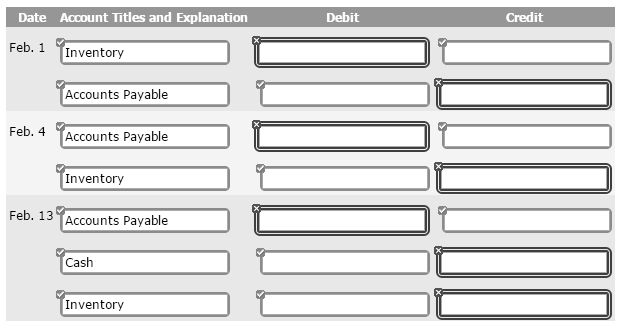

Assuming that Cruise uses the perpetual method for recording merchandise transactions, record the purchase, return, and payment using the gross method.

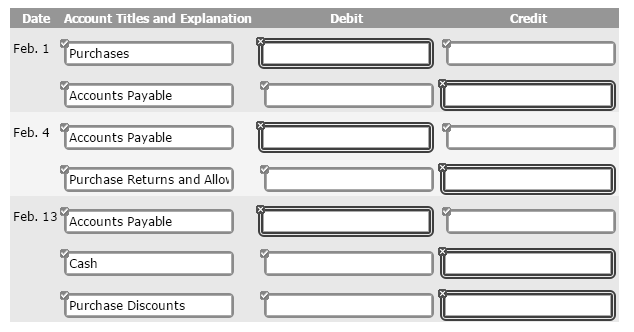

Assuming that Cruise uses the periodic method for recording merchandise transactions, record the purchase, return, and payment using the gross method.

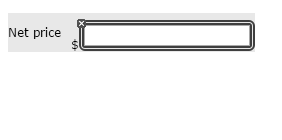

At what amount would the purchase on February 1 be recorded if the net method were used?

Date Account Titles and Explanation Feb. 1 Inventory Feb. 4 Accounts Payable Accounts Payable Inventory Feb. 13 Accounts Payable Cash Inventory Debit ONO Credit Conono Date Account Titles and Explanation Feb. 1Purchases Feb. 4 Feb. 13 Accounts Payable Accounts Payable Purchase Returns and Allov Accounts Payable Cash Purchase Discounts Debit DOODO Credit OOOOOO Net price

Step by Step Solution

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Record the purchase return and payment using the gross method Perpetual inventory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60968f98ce7d6_27004.pdf

180 KBs PDF File

60968f98ce7d6_27004.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started