Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Current E&P Calculation. Beach Corporation, an accrual basis taxpayer, reports the following results for the current year. a. What is Beach?s taxable income? b. What

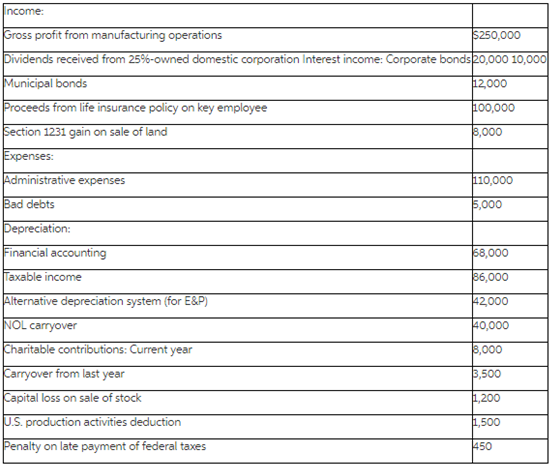

Current E&P Calculation. Beach Corporation, an accrual basis taxpayer, reports the following results for the current year.

a. What is Beach?s taxable income?

b. What is Beach?s current E&P.

Income: Gross profit from manufacturing operations $250,000 Dividends received from 25%-owned domestic corporation Interest income: Corporate bonds 20,000 10,000 12,000 100,000 8,000 Municipal bonds Proceeds from life insurance policy on key employee Section 1231 gain on sale of land Expenses: Administrative expenses Bad debts Depreciation: Financial accounting Taxable income Alternative depreciation system (for E&P) NOL carryover Charitable contributions: Current year Carryover from last year Capital loss on sale of stock U.S. production activities deduction Penalty on late payment of federal taxes 110,000 5,000 58,000 86,000 42,000 40,000 8,000 3,500 1,200 1,500 450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculate taxable income Taxable income is calculated by adding all income included in adjusted gross income deducting all deductions for adjusted gross income and deduction all deductions from all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started