Question

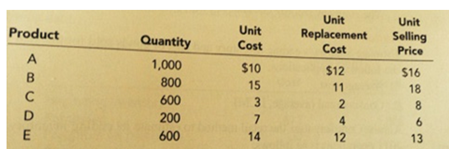

Decker Company has five products in its inventory. Information about the December 31 2011 inventory follows. The selling cost for each product consists of a

Decker Company has five products in its inventory. Information about the December 31 2011 inventory follows.

The selling cost for each product consists of a 15 percent sales commission. The normal profit percentage for each product is 40 percent of the selling price.

1. Determine the balance sheet inventory carrying value at December 31 2011 assuming the LCM rule is applied to individual products

2. Determined the balance sheet inventory carrying value at December 31 2011 assuming the LCM rule is applied to the entire inventory. Also assuming that Decker recognizes an inventory write down as a separate income statement item determine that amount of the loss.

Product A B D E Quantity 1,000 800 600 200 600 Unit Cost $10 15 3 7 14 Unit Replacement Cost $12 11 2 4 12 Unit Selling Price $16 18 8 6 13

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Inventory carrying value would be 28...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6098d67d9f25b_29216.pdf

180 KBs PDF File

6098d67d9f25b_29216.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started