Question

Divides on common stock during year 2 totaled $310 thousand. Dividends on preferred stock totaled $125 thousand. The market price of common stock at the

Divides on common stock during year 2 totaled $310 thousand. Dividends on preferred stock totaled $125 thousand. The market price of common stock at the end of year 2 was $ 9.58 per share.

Required: Compute the following for year 2.

a. Gross margin percentage. (Round your answer to 1 decimal place.) b. Earnings per share of common stock. (Round your answer to 2 decimal places.) c. Price-earnings ratio. (Round your intermediate calculations to 2 decimal places and final answer to 1 decimal place.) d. Dividend payout ratio. (Round your intermediate calculations to 2 decimal places and final answer to 1 decimal place.) e. Dividend yield ratio. (Round your answer to 2 decimal places.) f. Return on total assets. (Round your intermediate calculations and final answer to 2 decimal places.) g. Return on common stockholders' equity. (Round your answer to 2 decimal places.) h. Book value per share. (Round your answer to 2 decimal places.) i. Working capital. j. Current ratio. (Round your answer to 2 decimal places.) k. Acid-test ratio. (Round your answer to 2 decimal places.) l. Accounts receivable turnover. (Round your answer to 2 decimal places.) m. Average collection period. (Assume 365 days a year and round your answer to 1 decimal place.) n. Inventory turnover. (Round your answer to 2 decimal places.) o. Average sale period. (Assume 365 days a year and round your answer to 1 decimal place.) p. Times interest earned. (Round your answer to 2 decimal places.) q. Debt-to-equity ratio. (Round your answer to 2 decimal places.)

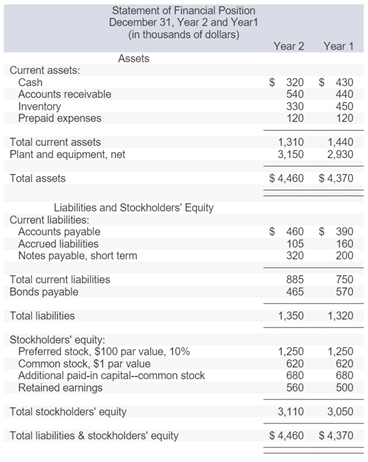

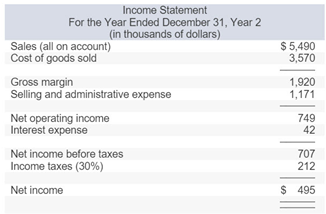

Current assets: Cash Statement of Financial Position December 31, Year 2 and Year1 (in thousands of dollars) Assets Accounts receivable Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Notes payable, short term Total current liabilities Bonds payable Total liabilities Stockholders' equity: Preferred stock, $100 par value, 10% Common stock, $1 par value Additional paid-in capital--common stock Retained earnings Total stockholders' equity Total liabilities & stockholders' equity Year 2 $ 320 540 330 120 Year 1 885 465 1,350 $ 430 440 1,310 1,440 3,150 2,930 $4,460 $4,370 1,250 620 680 560 450 120 $ 460 $ 390 105 160 320 200 750 570 1,320 1,250 620 680 500 3,110 3,050 $4,460 $4,370 Income Statement For the Year Ended December 31, Year 2 (in thousands of dollars) Sales (all on account) Cost of goods sold Gross margin Selling and administrative expense Net operating income Interest expense Net income before taxes Income taxes (30%) Net income $ 5,490 3,570 1,920 1,171 749 42 707 212 $ 495

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Gross Margin Percentage is the percentage of Gross profit to the Total sales Hence the Gross margin ratio is calculated as below Gross Margin Total Sales 19205490 100 350 Rounded off to 1 decimal b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6096f91abccfb_27370.pdf

180 KBs PDF File

6096f91abccfb_27370.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started