Question

Docs R Us has performed a risk assessment of independent projects. They adjust for project risk by raising the calculated IRR by 3% for low

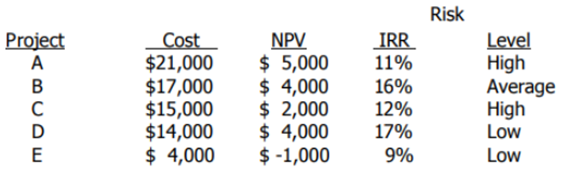

Docs R Us has performed a risk assessment of independent projects. They adjust for project risk by raising the calculated IRR by 3% for low risk projects, leaving the IRR the same for moderate risk projects, and lowering the calculated IRR by 2% for high risk projects. Without capital rationing, and given their cost of capital of 11%, which projects should Meds R Us accept? Why?

Note: You will add 3% to the Project's IRR if it is low risk (making it look more favorable since it is), leave Average risk Projects' IRRs the same, and subtract 2% from the IRR for high risk Projects (making them less favorable since they are due to the risk).

Project A BUDE Cost $21,000 $17,000 $15,000 $14,000 $4,000 NPV $ 5,000 $ 4,000 $ 2,000 $ 4,000 $-1,000 IRR 11% 16% 12% 17% 9% Risk Level High Average High Low Low

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Risk Project Cost NPV IRR Level Adjustment to IRR Adjusted IRR A 21000 5000 11 High 112 9 B 17...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6094369d9b318_24610.pdf

180 KBs PDF File

6094369d9b318_24610.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started