Question

Dorothy Products sells its products for $20 per unit. Additional data for the month of April, 2014, are as follows: Using variable costing, calculate the

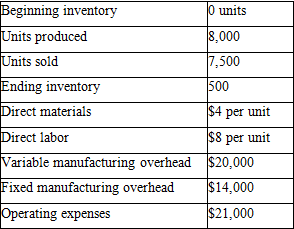

Dorothy Products sells its products for $20 per unit. Additional data for the month of April, 2014, are as follows:

Using variable costing, calculate the product cost per unit produced.

Beginning inventory Units produced Units sold Ending inventory Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Operating expenses 0 units 8,000 7,500 500 $4 $8 per unit $20,000 $14,000 $21,000 per unit

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Variable Costing Direct materials 4 8000 units ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting What the Numbers Mean

Authors: David H. Marshall, Wayne W. McManus, Daniel F. Viele,

9th Edition

978-0-07-76261, 0-07-762611-7, 9780078025297, 978-0073527062

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App