Question: Efficient Business Systems uses a perpetual inventory system. The adjusted trial balance of Efficient Business Systems at March 31,2018, follows: Prepare Efficient?s multi-step income statement

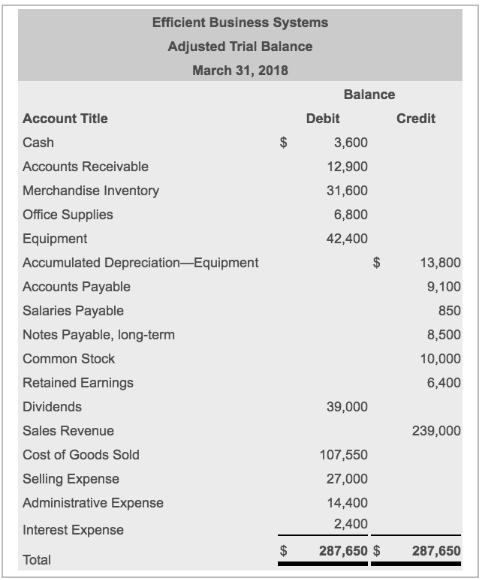

Efficient Business Systems uses a perpetual inventory system. The adjusted trial balance of Efficient Business Systems at March 31,2018, follows:

Prepare Efficient?s multi-step income statement for the year ended March 31,2018.

Efficient Business Systems Adjusted Trial Balance March 31, 2018 Account Title Cash Accounts Receivable Merchandise Inventory Office Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Notes Payable, long-term Common Stock Retained Earnings Dividends Sales Revenue Cost of Goods Sold Selling Expense Administrative Expense Interest Expense Total $ $ Debit Balance 3,600 12,900 31,600 6,800 42,400 39,000 LA 107,550 27,000 14,400 2,400 287,650 $ Credit 13,800 9,100 850 8,500 10,000 6,400 239,000 287,650

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

To prepare a multistep income statement follow these steps Step 1 Calculate Gross Profit Gross Profi... View full answer

Get step-by-step solutions from verified subject matter experts