Question

Everything Equine Corp. (EEC) is a publicly accountable enterprise that specializes in providing horse-related goods and services to horse owners. EEC commenced operations on January

Everything Equine Corp. (EEC) is a publicly accountable enterprise that specializes in providing horse-related goods and services to horse owners. EEC commenced operations on January 1, 20X2. Select details of transactions with respect to EEC's property, plant and equipment (PPE) and intangible assets are as follows:

April 1, 20X2

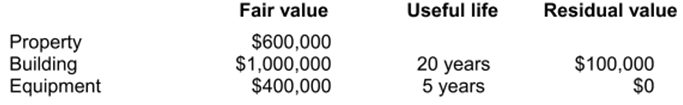

- EEC purchased the PPE of a company in financial distress for $1,800,000 and immediately brought it into use. At the time of purchase, an independent appraiser provided the following valuation of the PPE purchased by the company:

- EEC paid a $32,000 transaction tax to the provincial government relating to the purchase of the property and building. This was a non-refundable tax. EEC also paid its lawyers $9,000 in legal fees for finalizing the purchase agreement for the PPE.

April Ito June 30, 20X2

- EEC spent $350,000 researching a new horse vaccine and obtained a patent for it.

July1 to December 31, 20X2

- On July 1, 20X2, EEC determined that the vaccine was commercially viable and met the IFRS requirements for capitalization of development expenses.

- During the remainder of 20X2, EEC spent an additional $450,000 developing the vaccine. The Canadian government was keenly interested in EEC's vaccine as it was expected to be very beneficial to the Canadian equestrian industry, and it provided a $180,000 grant to EEC to assist with the completion of the vaccine's development. The government grant was forgivable once the vaccine was available for purchase by the public

January 20X3

- Development of the vaccine was completed and sales commenced in January 20X3. At that time, EEC estimated that the remaining useful life of the vaccine patent was six years.

- EEC spent a total of $80,000 on maintaining and repairing its equipment. These expenditures were incurred as follows: $10,000 was for routine maintenance and the remaining $70,000 was for a replacement part that was expected to extend the useful life of the equipment by one year.

Other information:

- EEC uses the cost model to value its PPE and intangible assets. It depreciates all depreciable assets on an annual basis using the straight-line method. The company expenses a full month of depreciation in the first month of use.

- EEC expects that it will be able to fully comply with all terms and conditions of the government assistance. It elects to use the net method to report the government aid.

- Assume that all expenses noted in the question are paid in cash.

- While the resulting journal entries will all be entered to the nearest dollar, EEC rounds all dollar-based calculations to the nearest whole cent (for example, $21.46) and percentages to two decimal places (for example, 13.41%). You should do likewise in your supporting calculations.

Required:

(a) Calculate the allocated cost of PPE at April 1, 20X2. Determine the total depreciation and amortization expense EEC will record for the 20X2 and 20X3 fiscal years. (Calculate the depreciation/amortization expense per month for all depreciable assets.) Calculate the net book value of PPE as at December 31, 20X2, and December 31, 20X3.

(b) Record a summary of the journal entries pertaining to the identified transactions in the same order as those presented in the question for both 20X2 and 20X3. Prepare a separate journal entry for each expenditure and receipt. Ensure that the journal entries are dated and include a brief description of the pertinent details. Supporting calculations are to be referenced or included in the description.

(c) Record the year-end adjusting journal entries pertaining to depreciation and amortization for both 20X2 and 20X3. Ensure that the journal entries are dated and include a brief description of the pertinent details. Prepare a separate journal entry pertaining to each asset class. Supporting calculations are to be referenced or included in the description.

Property Building Equipment Fair value $600,000 $1,000,000 $400,000 Useful life 20 years 5 years Residual value $100,000 $0

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Cost of PPE for the year ending 20x3 a PPE Total EEC expenses 800007000010000 160000000 b Journal Su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started