Question

Explosive Entertainment Inc. (EEI) is a wholesaler that sells three lines of sound systems. Pertinent details of the company follow: EEI purchases and resells the

Explosive Entertainment Inc. (EEI) is a wholesaler that sells three lines of sound systems.

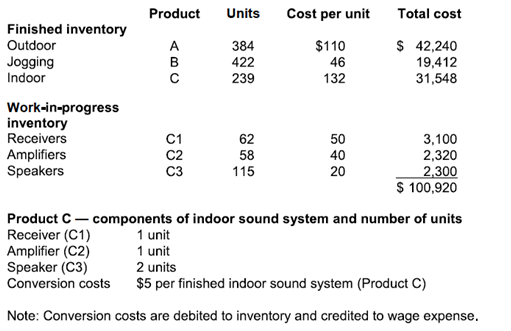

Pertinent details of the company follow:

- EEI purchases and resells the outdoor Product A and jogging Product B sound systems without alteration. For its indoor Product C sound system. EEI purchases the three component parts from separate producers and then assembles the finished product on its premises.

- EEI tracks its inventory using a perpetual inventory system and values it using the weighted average cost formula.

- The terms of all of EElis sales are FOB shipping point ? that is. EEI records revenue when the product is shipped from its premises. EEI normally offers credit terms of 2/10. net 30 to its retail clients. The company records its accounts receivable using the gross method. EEI sells strictly on a cash basis to unestablished new clients. EEI also occasionally offers extended payment terms to well-established clients and tailors the credit terms to suit the specific situation.

- The terms of all of EEI's purchases are FOB destination ? that is. EEI takes ownership of the goods when received from the vendor. All but one of EEI's suppliers offer 30-day credit. Terms to the company. The exception is Active Co.. which supplies the jogging sound system (Product B). Active Co. offers EEI terms of 1/15, net 30. EEI records its accounts payable using the gross method.

- While the resulting journal entries will all be entered to the nearest dollar, EEI rounds all dollar-based calculations to the nearest whole cent (for example, $21.46) and percentages to two decimal places (for example, 13.41%). You should do likewise in your supporting calculations.

- EEI's opening inventory as at December 1, 20X4, follows:

El maintains separate general ledger accounts for finished inventory and work-in-progress (MIDI inventory.

El maintains separate general ledger accounts for finished inventory and work-in-progress (MIDI inventory.

EEI's inventory-related transactions for December 20X4 (not recorded in the company's accounting records) are as follows:

December 1, 20X4:

(i) EEI received 100 units of Product A from Electronics Ltd at a cost of $105 per unit plus a total of S200 freight-in.

(ii) EEI received 200 units of Product B from Active Co. at a total cost of $8,800.

(iii) EEI received a $9,800 payment on account from Mega Retailer Corp. (MRC) within the 10-day discount period for goods sold in November 20X4.

December 6, 20X4:

(iv) EEI sold 80 units of Product A for S16,000 cash.

December 8, 20X4:

(v) EEI received 200 units of Product A from Electronics Ltd. at a cost of $98 per unit plus $300 freight-in and $980 CST,

(vi) EEI received an $11,500 payment on account from MRC. This payment was received 25 days after the invoice date for goods sold in November 20X4.

(vii) EEI assembled 50 units of Product C.

December 12, 20X4:

(viii) EEI paid the invoice pertaining to the units of Product B received on December 1, 20X4.

(ix) EEI accepted a one-year, interest-free, $57,000 note from Stereo Discounter Corp. (SDC) in exchange for 200 units of Product C. The cash-equivalent sales price for the goods was $54,000.

(x) EEI shipped 100 units of Product A to Clarity Inc. and invoiced the company for $20,000.

December 18, 20X4:

(xi) EEI received payment in full from Clarity for the sale of Product A on December 12, 20X4.

(xii) EEI shipped 300 units of Product B to Clarity on a priority basis and invoiced the customer for $27,700, including $100 of freight costs.

December 24, 20X4:

(xiii) EEI sold 150 units of Product A to Renegade Retail Corp. (RRC) for $30,000 before an expected price increase took effect on January 1, 20X5. As RRC does not have sufficient storage space on its premises, EEI has agreed to store the inventory at its premises on behalf of the customer. Given the generic nature of the product, and as EEI almost always has this inventory in stock, EEI did not specifically segregate the inventory that it agreed to sell to RRC.

December 30, 20X4:

(xiv) EEI shipped 50 units of Product A to RRC relating to the sale of goods on December 24, 20X4.

(xv) EEI received payment in full from Clarity for the sale of Product B on December 18, 20X4.

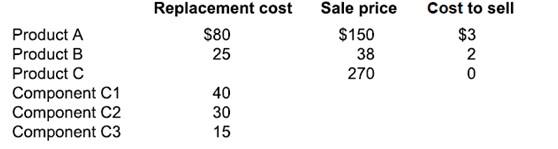

- During December 20X4, several factors impacted both the price that EEI pays for its product and the price for which it can sell the finished product. EEI compiled the information that follows, with the effective date of these costs and prices being December 31, 20X4.

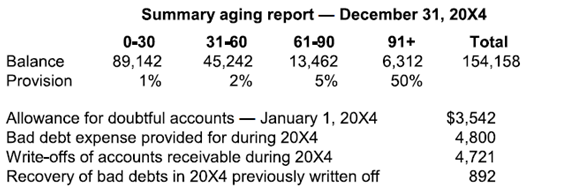

- EEI reviewed its accounts receivable at its December 31, 20X4, year end and determined that it needed an allowance for doubtful accounts equal to the following:

- 1% of accounts aged from 0 to 30 days

- 2% of accounts aged from 31 to 60 days

- 5% of accounts aged from 61 to 90 days

- 50% of accounts aged 91 days and longer

A summary of EEI's accounts receivable and other pertinent information follows:

Required:

(a) Calculate the cost of goods sold (COGS) for the month of December 20X4 before the required adjustments, if any, are made to value EEI's inventory at the lower of cost and net realizable value. Provide separate totals for each category of inventory as well as the total COGS.

(b) Calculate the closing inventory as at December 31, 20X4, after the required adjustments, if any. are made to value EEI's inventory at the lower of cost and net realizable value. Provide separate totals for each category of inventory as well as the total inventory holdings.

(c) Determine the remaining bad debt expense that needs to be recorded by EEI at the end of the 20X4 fiscal year.

(d) Record the journal entries pertaining to the identified transactions in the same order as those presented in the question. Ensure that the journal entries are dated and include a brief description of the pertinent details. Supporting calculations are to be referenced or included in the description.

Finished inventory Outdoor Jogging Indoor Work-in-progress inventory Receivers Amplifiers Speakers Product Units Cost per unit A 384 $110 B 422 46 239 132 C3 62 58 115 50 40 20 Total cost $ 42,240 19,412 31,548 3,100 2,320 2,300 $ 100,920 Product C-components of indoor sound system and number of units Receiver (C1) 1 unit Amplifier (C2) 1 unit Speaker (C3) 2 units Conversion costs $5 per finished indoor sound system (Product C) Note: Conversion costs are debited to inventory and credited to wage expense. Product A Product B Product C Component C1 Component C2 Component C3 Replacement cost $80 25 40 30 15 Sale price $150 38 270 Cost to sell $3 NO 2 0 Balance Provision Summary aging report - December 31, 20X4 31-60 61-90 45,242 13,462 2% 5% 0-30 89,142 1% Allowance for doubtful accounts - January 1, 20X4 Bad debt expense provided for during 20X4 91+ 6,312 50% Write-offs of accounts receivable during 20X4 Recovery of bad debts in 20X4 previously written off Total 154,158 $3,542 4,800 4,721 892

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a cost of goods sold opening stock purchases carriage inwards closing stock opening inventory UNITS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started