Question

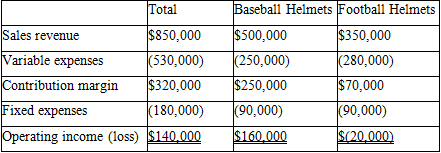

Faros Hats, Etc. has two product lines-baseball helmets and football helmets. Income statement data for the most recent year follow: If $50,000 of fixed costs

Faros Hats, Etc. has two product lines-baseball helmets and football helmets. Income statement data for the most recent year follow:

If $50,000 of fixed costs will be eliminated by dropping the Football Helmets line, how will dropping Football Helmets affect the operating income of the company?

A) Operating income will increase by $50,000.

B) Operating income will increase by $70,000.

C) Operating income will decrease by $90,000.

D) Operating income will decrease by $20,000.

Sales revenue Variable expenses Contribution margin Total $850,000 (530,000) $320,000 Fixed expenses (180,000) Operating income (loss) $140,000 Baseball Helmets Football Helmets $500,000 $350,000 (250,000) (280,000) $250,000 $70,000 (90,000) (90,000) $160,000 $(20,000)

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

D Operating income will decrease by 20000 Explanatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Cost Accounting

Authors: William Lanen, Shannon Anderson, Michael Maher

5th edition

978-1259728877, 1259728870, 978-1259565403

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App