Question

For the summer session of 20X2, Pacific University assessed its students $1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However,

For the summer session of 20X2, Pacific University assessed its students $1,700,000 (net of refunds) covering tuition and fees for educational and general purposes. However, only 51.500.000 was expected to be realized because scholarships totaling 5150.000 were granted to students, and tuition remissions of $50,000 were allowed to faculty members' children attending Pacific. What amount should Pacific include as revenues from student tuition and fees? a. $1,500,000. b. $1,550,000. c. $1,650,000. d. 81.700.000.

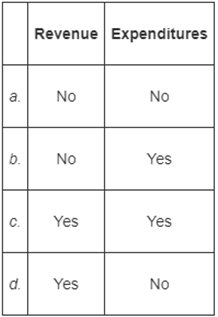

2. Tuition remissions for graduate student teaching assistant ships should be classified by a university as:

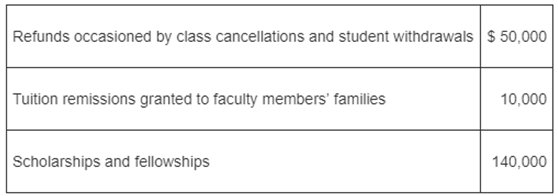

3. For the fall semester Of 20X1, Dover University assessed its students $2,300,000 for tuition and fees. The net amount realized was only $2,100,000 because of the following revenue reduction.

How much should Dover report for the period for revenue from tuition and fees? a. $2,100,000. b. $2,150,000. c.. $2,250,000. d. $2,300,000.

Items 4 through 6 are based on the following information pertaining to Global University, a private institution, as of June 30, 20X1, and for the year then ended:

Unrestricted net assets comprised $7,500,000 of assets and $4,500,000 of liabilities (including deferred revenues of $150,000). Among the receipts recorded during the year were unrestricted gifts of $550,000 and restricted grants totaling $330,000, of which $220,000 was expended during the year for current operations and $110,000 remained expended at the close of the year.

Volunteers from the surrounding communities regularly contribute their services to Global and are paid nominal amounts to cover their travel costs. During the year, the amount for travel paid to these volunteers aggregated 518.000. The gross value of services performed by them, determined by reference to equivalent wages available in that area for similar services, amounted to $200,000. Global University normally purchases these types of contributed services. and the university believes the contributed services enhance its assets.

4. At June 30. 20X1, Global?s unrestricted net asset balance was: a. $7,500,000. b. $3,150,000. c. $3,000,000. d. $2,850,000.

5. For the year ended June 30, 20X1, what amount should be included in Global's revenue for the unrestricted gifts and restricted grants? a. $550,000. b. $660,000. c. $770,000. d, $880,000.

6. For the year ended June 30, 20X1, what amount should Global record as contribution revenue for the volunteers? services? a. $218,000. b. $200,000. c. $18,000. d. $0.

a. No b. C. Revenue Expenditures d. No Yes Yes No Yes Yes No Refunds occasioned by class cancellations and student withdrawals $50,000 Tuition remissions granted to faculty members' families Scholarships and fellowships 10,000 140,000

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 a 2 c 3 a 4 c 7500000 assets 4500000 liabilities ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started