Question

For this exercise, use the following tax rates: FICA-Employer and employee, 8% of the first $120,000 of earnings per employee per calendar year. State unemployment-4%

For this exercise, use the following tax rates:

FICA-Employer and employee, 8% of the first $120,000 of earnings per employee per calendar year.

State unemployment-4% of the first $8,000 of earnings per employee per calendar year.

Federal unemployment-1% of the first $8,000 of earnings per employee per calendar year.

Federal income tax withholding-10% of each employee's gross earnings, unless otherwise stated.

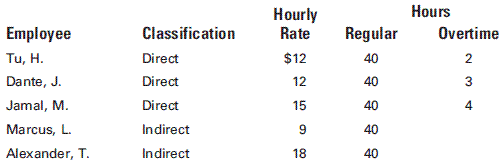

A weekly payroll summary made from labor time records shows the following data for Pima Company:

Overtime is payable at one-and-a-half times the regular rate of pay and is distributed to all jobs worked on during the period.

If required, round your answers to the nearest cent in all parts.

Determine the income tax and net pay of each employee. The income taxes withheld for each employee amount to 15% of the gross wages.

Employee Tu, H. Dante, J. Jamal, M. Marcus, L. Alexander, T. Classification Direct Direct Direct Indirect Indirect Hourly Rate Regular $12 40 12 40 15 40 9 40 18 40 Hours Overtime 2 3 4

Step by Step Solution

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6099a317566ad_29880.pdf

180 KBs PDF File

6099a317566ad_29880.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started