Question

Kim Company's western territory's forecasted income statement for the upcoming year is as follows: Kim Company's management is considering dropping the western territory and has

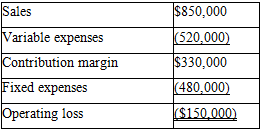

Kim Company's western territory's forecasted income statement for the upcoming year is as follows:

Kim Company's management is considering dropping the western territory and has determined that 80% of the fixed expenses are avoidable. What is the change in Kim Company's forecasted operating loss for the upcoming year if the western territory is dropped? Assume the company predicts an operating loss across the entire company.

A) Loss will be reduced by $54,000.

B) Loss will be increased by $60,000.

C) Loss will be reduced by $480,000.

D) Loss will be increased by $384,000.

Sales Variable expenses Contribution margin Fixed expenses Operating loss $850,000 (520,000) $330,000 (480,000) ($150,000)

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

A Loss will be reduced by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Accounting

Authors: Belverd E. Needles, Marian Powers and Susan V. Crosson

12th edition

978-1133603054, 113362698X, 9781285607047, 113360305X, 978-1133626985

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App