Question

Kissimmee Paint Co. reported the following data for the month of July. There were no beginning inventories and all units were completed (no work in

Kissimmee Paint Co. reported the following data for the month of July. There were no beginning inventories and all units were completed (no work in process).

Selling and administrative expenses:

Variable????????$2 per unit sold

Fixed????????????.$39,000

In the month of July, 28,000 of the 30,000 units manufactured were sold at a price of $80 per unit.

(a) Prepare a variable costing income statement.

(b) Prepare an absorption costing income statement.

(c) Briefly explain why there is a difference in income from operations between the two methods.

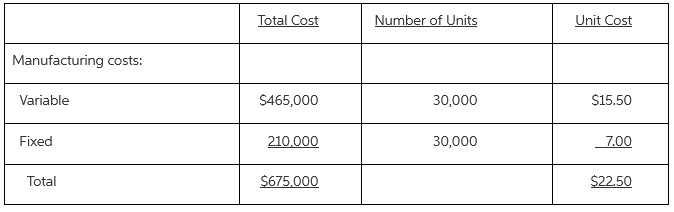

Manufacturing costs: Variable Fixed Total Total Cost $465,000 210,000 $675,000 Number of Units 30,000 30,000 Unit Cost $15.50 7.00 $22.50

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Variable costing income statement should be prepared as follows b Absorption cost...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial and Managerial Accounting

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

2nd edition

978-0538473484, 538473487, 978-1111879044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App