Knox Instruments, Inc., is a manufacturer of various medical and dental instruments. Financial statement data for the firm follow. (Thousands of Dollars, 1993 ?????????????????? except

Knox Instruments, Inc., is a manufacturer of various medical and dental instruments. Financial statement data for the firm follow.

(Thousands of Dollars,

1993 ?????????????????? except per Share Amount)

Net Sales ??????????????????????... $ 200,000

Cost of Goods Sold ???????????????????? 98,000

Net Income ??????????????????????.? 10,000

Dividends ????????????????????????. 4,200

Net Cash Provided by Operating Activities ???????????. 7,800

Earnings per Share ?????????????????????. 2.71

Required

Using the given data, calculate items 1 through 9 for 1993.

Current ratio

Quick Ratio

Average collection period

Inventory turnover

Operating cash flow to current liabilities ratio

Debt-to-equity ratio

Return on assets

Return on common stockholders? equity

Return on sales.

Calculate the dividends paid per share of common stock.(Use average number of shares outstanding during the year).What was the dividend pay-out ratio?

If the 1993 year-end price per share of common stock is $25, what is (1) the price-earnings ratio? (2) the dividend yield?

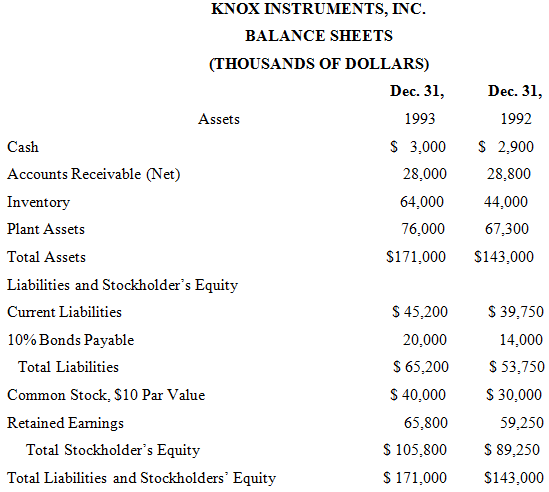

Cash Accounts Receivable (Net) Inventory Plant Assets Total Assets KNOX INSTRUMENTS, INC. BALANCE SHEETS (THOUSANDS OF DOLLARS) Dec. 31, Dec. 31, 1993 1992 $ 3,000 $ 2,900 28,000 28,800 64,000 44,000 76,000 67,300 $171,000 $143,000 Assets Liabilities and Stockholder's Equity Current Liabilities 10% Bonds Payable Total Liabilities Common Stock, $10 Par Value Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholders' Equity $ 45,200 20,000 $ 65,200 $ 40,000 65,800 $ 105,800 $ 171,000 $ 39,750 14,000 $ 53,750 $ 30,000 59,250 $ 89,250 $143,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Return on assets Net incomeAverage total Assets Return on common stockholderss equity Net incomeA...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started