Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Match the following financial ratios that are based on comprehensive annual financial report (CAFR) information with the explanation for that ratio. Answer can be used

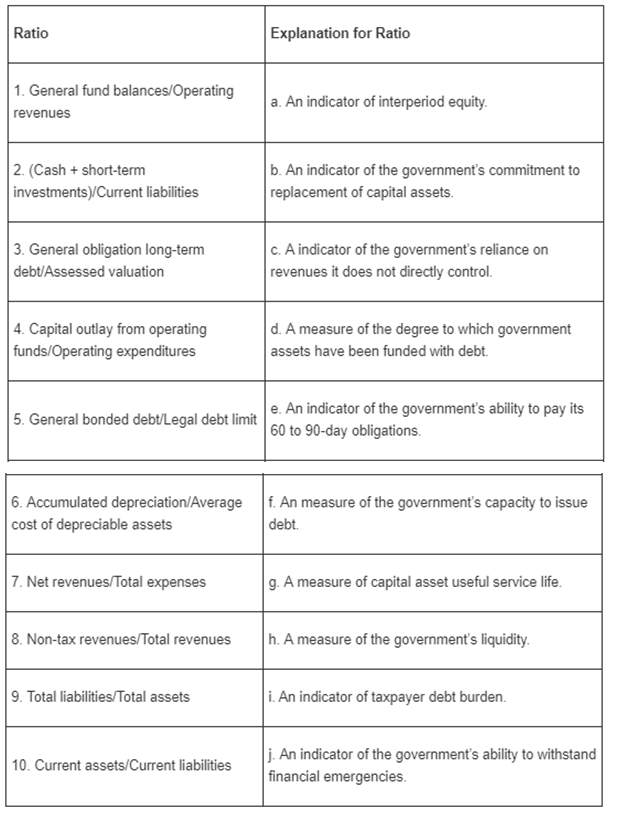

Match the following financial ratios that are based on comprehensive annual financial report (CAFR) information with the explanation for that ratio. Answer can be used once.

Ratio 1. General fund balances/Operating revenues 2. (Cash + short-term investments)/Current liabilities 3. General obligation long-term debt/Assessed valuation 4. Capital outlay from operating funds/Operating expenditures 5. General bonded debt/Legal debt limit 6. Accumulated depreciation/Average cost of depreciable assets 7. Net revenues/Total expenses 8. Non-tax revenues/Total revenues 9. Total liabilities/Total assets 10. Current assets/Current liabilities Explanation for Ratio a. An indicator of interperiod equity. b. An indicator of the government's commitment to replacement of capital assets. c. A indicator of the government's reliance on revenues it does not directly control. d. A measure of the degree to which government assets have been funded with debt. e. An indicator of the government's ability to pay its 60 to 90-day obligations. f. An measure of the government's capacity to issue debt. g. A measure of capital asset useful service life. h. A measure of the government's liquidity. i. An indicator of taxpayer debt burden. j. An indicator of the government's ability to withstand financial emergencies.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 j 2 e ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609b09f0ba904_31259.pdf

180 KBs PDF File

609b09f0ba904_31259.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started