Question

Maurice Inc. was started on January 1, 2017 and provided you with the following ending balances of its accounts on December 31, 2017: ? Note

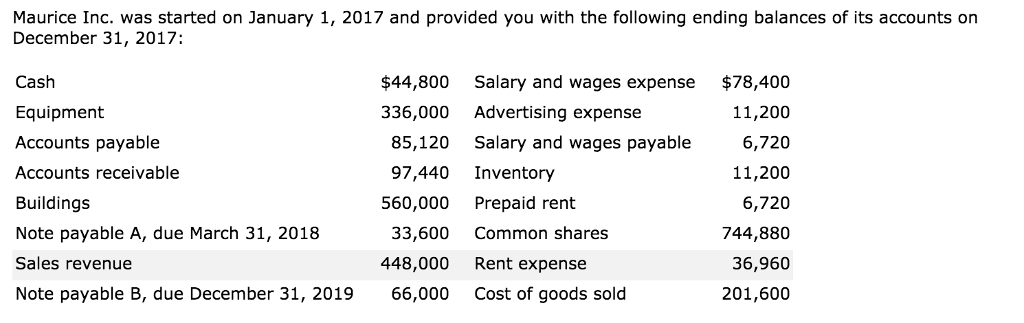

Maurice Inc. was started on January 1, 2017 and provided you with the following ending balances of its accounts on December 31, 2017:

? Note payable A was issued by Maurice Inc. on March 31, 2017. The principal and the interest are due on March 31, 2018. Annual interest rate is 100/0. The interest expense for 2017 was not recorded.

? Note payable B was issued by Maurice Inc. on July 1, 2017. The interest is payable semi-annually on July 1 and January 1 every year. Annual interest rate is 8%. The principal is due on December 31, 2019. Interest on Note B has not been recorded in 2017.

What is the interest expense?

Maurice Inc. was started on January 1, 2017 and provided you with the following ending balances of its accounts on December 31, 2017: Cash Equipment Accounts payable Accounts receivable Buildings Note payable A, due March 31, 2018 Sales revenue Note payable B, due December 31, 2019 $44,800 336,000 85,120 97,440 560,000 33,600 448,000 66,000 Salary and wages expense $78,400 Advertising expense 11,200 Salary and wages payable 6,720 Inventory 11,200 Prepaid rent 6,720 Common shares 744,880 36,960 201,600 Rent expense Cost of goods sold

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Note payable A was issued on March 31 2017 hence inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6099f737280d8_30197.pdf

180 KBs PDF File

6099f737280d8_30197.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started