Mr. Eric Wong operates a real estate agency that specializes in selling properties that are hard to sell. He is approached one day by a

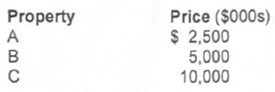

Mr. Eric Wong operates a real estate agency that specializes in selling properties that are hard to sell. He is approached one day by a prospective client who has three properties he wishes to sell. The client indicates the prices he wishes to receive for these properties as follows:

Eric would receive a commission of 4% on any of the properties he is able to sell.

The client laid down the following conditions for an exclusive listing:

Eric, you have to sell the property A first. If you can t sell it within a month, the entire deal is off?no commission and no chance to sell the other properties. If you sell property A within a month, then III give you the commission for it and the option of (a) stopping at this point; or (b) trying to sell either B or C next under the same conditions (i.e.. sell within a month or no commission on the second property and no chance to sell the third property). If you succeed in selling the first two properties. you will also have the option of selling the third.

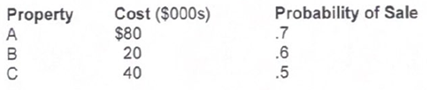

After the client has left, Eric proceeds to analyze the proposal to determine whether or not to accept it. He figures his selling costs and his chances of selling each property at the set prices to be:

He believes that sale of a particular property would not make it any more or less likely that the two remaining properties could be sold. Selling costs would have to be incurred whether or not a particular property is sold but could be avoided by deciding not to attempt to sell the property.

Questions:

1. Draw a decision tree to find Eric's best choices.

2. Find the expected values of perfect information, respectively, about

(i) Whether A can be sold at the set price;

(ii) Whether B can be sold at the set price.

(iii) Whether C can be sold at the set price.

Property A B C Price ($000s) $ 2,500 5,000 10,000 Property A B C Cost ($000s) $80 20 40 Probability of Sale .7 .6 .5

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Decision tree is as follows 2 EV of node 8 N3 SUMPRODUCTP2P4Q2Q4 EV of node 9 N11 SUMPRODUCTP10...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started