Question

Multiple Choice Questions: 1) Which of following statements is true of short-term decision making? A) Fixed costs and variable costs must be analyzed separately. B)

Multiple Choice Questions:

1) Which of following statements is true of short-term decision making?

A) Fixed costs and variable costs must be analyzed separately.

B) All costs behave in the same way.

C) Unit manufacturing costs are variable costs.

D) All costs involved in a decision are considered relevant.

2) The contribution margin approach helps managers in short-term decision making because:

A) It treats fixed manufacturing overhead as a product cost.

B) It reports only mixed costs.

C) It reports costs and revenues at present value.

D) It isolates costs by behavior.

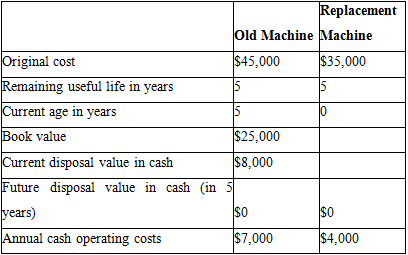

3) Smith Industries is considering replacing a machine that is presently used in its production process. The following information is available:

Which of the information provided in the table is irrelevant to the replacement decision?

A) The price of the new machine

B) The original cost of the old machine

C) The current disposal value of the old machine

D) Annual operating costs

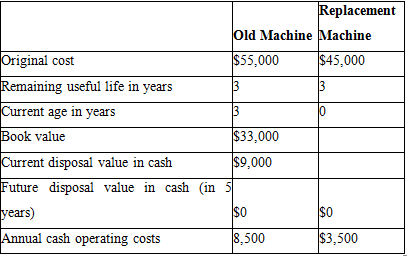

4) Smith Industries is considering replacing a machine that is presently used in its production process. The following information is available:

Which of the following amounts represent a sunk cost?

A) $55,000

B) $33,000

C) $9,000

D) $45,000

5) Which of the following pieces of information would be irrelevant in deciding to upgrade a company's heating and air conditioning system?

A) The energy efficiency of the old equipment versus the energy efficiency of the new equipment

B) The safety of the new equipment compared to the old equipment

C) The purchase price of the old equipment compared to the purchase price of the new equipment

D) The productivity of the old equipment compared to that of the new equipment

Original cost Remaining useful life in years Current age in years Book value years) Annual cash operating costs Old Machine Machine $45,000 $35,000 5 5 $25,000 $8,000 Current disposal value in cash Future disposal value in cash (in 5 $0 $7,000 Replacement 15 10 $0 $4,000 Original cost Remaining useful life in years Current age in years Book value Old Machine Machine $55,000 $45,000 3 $33,000 $9,000 Replacement Current disposal value in cash Future disposal value in cash (in 5 years) $0 Annual cash operating costs 8,500 13 10 $0 $3,500

Step by Step Solution

3.25 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 A Fixed costs and variable costs must be analy...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started