Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2014, Rich Ltd was incorporated. The accounting profit and other relevant information of Rich Ltd for the three years to 2017 are

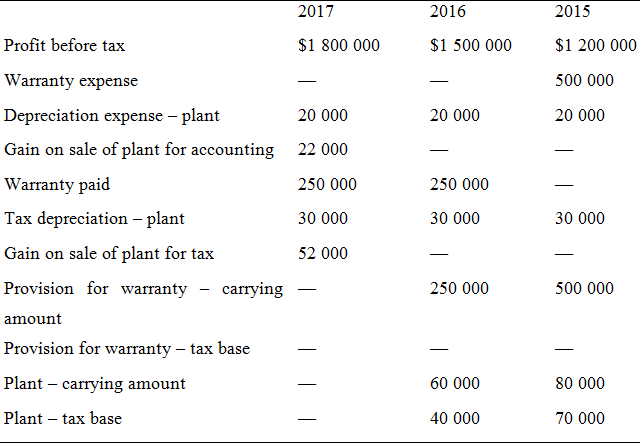

On 1 July 2014, Rich Ltd was incorporated. The accounting profit and other relevant information of Rich Ltd for the three years to 2017 are as follows:

The company tax rate is 30%.

Calculate the current and deferred tax of Rich Ltd for each year, 2015, 2016 and 2017, and prepare the required tax journal entries for each year.Profit before tax Warranty expense Depreciation expense - plant Gain on sale of plant for accounting Warranty paid Tax depreciation - plant Gain on sale of plant for tax Provision for warranty amount Provision for warranty - tax base Plant - carrying amount Plant - tax base carrying 2017 $1 800 000 20 000 22 000 250 000 30 000 52 000 2016 $1 500 000 20 000 250 000 30 000 250 000 60 000 40 000 2015 $1 200 000 500 000 20 000 - 30 000 500 000 80 000 70 000

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Current Tax Worksheet For the year ended 30 June 2015 Accounting profit 1 200 000 Add Warranty expense 500 000 Depreciation expense plant 20 000 520 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started