Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, Year 1, Kardashian Company recorded an adjusting entry to recognize uncollectible accounts expense. Kardashian had credit sales of $547,000 and estimates uncollectible

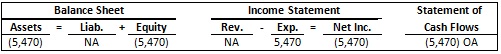

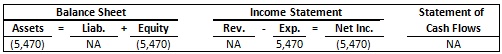

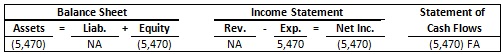

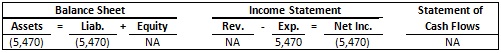

On December 31, Year 1, Kardashian Company recorded an adjusting entry to recognize uncollectible accounts expense. Kardashian had credit sales of $547,000 and estimates uncollectible accounts expense to be one percent of credit sales. Which of the following shows how this entry will affect Kardashian?s financial statements?

Balance Sheet Assets = Liab. + (5,470) NA Equity (5,470) Rev. NA Income Statement Exp. = 5,470 Net Inc. (5,470) Statement of Cash Flows (5,470) OA Assets (5,470) Balance Sheet Liab. + Equity NA (5,470) Rev. Income Statement Exp. 5,470 = Net Inc. (5,470) Statement of Cash Flows Assets (5,470) Balance Sheet Liab. + Equity NA (5,470) Rev. NA Income Statement Exp. 5,470 = Net Inc. (5,470) Statement of Cash Flows (5,470) FA Balance Sheet Assets = Liab. + Equity (5,470) (5,470) Rev. Income Statement Exp. = 5,470 Net Inc. (5,470) Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Explanation The uncollectible accounts expense is 5470 547000 x 1 ie Cred...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6096377f6dc4e_26713.pdf

180 KBs PDF File

6096377f6dc4e_26713.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started