Question

On June 15, 20010, Dick Schmitt and Joan Allen formed Hart Corporation to sell fishing equipment and small boats through an online catalog site. Pertinent

On June 15, 20010, Dick Schmitt and Joan Allen formed Hart Corporation to sell fishing equipment and small boats through an online catalog site. Pertinent information regarding Hart is summarized as follows:

? The business address is 1206 South Sixth Street, Nashville, TN 37203.

? The employer identification number is 57-3452933; the principal business activity code is 423910.

? Dick owns 40% and Joan owns 60% of the outstanding common stock; no other class of stock is authorized. Dick is president of the company, and Joan is the VP of Finance and Treasurer. Both are full-time employees of the corporation, and each receives a salary of $170,000. Dick?s Social Security number is 292-50-2953; Joan?s Social Security number is 232-30-4495.

? The corporation uses the accrual method of accounting and reports on a calendar year basis. Inventories are determined using the lower of cost or market method. For book purposes, the straight-line method of depreciation is used.

? During 2014, the corporation distributed a cash dividend of $30,000.

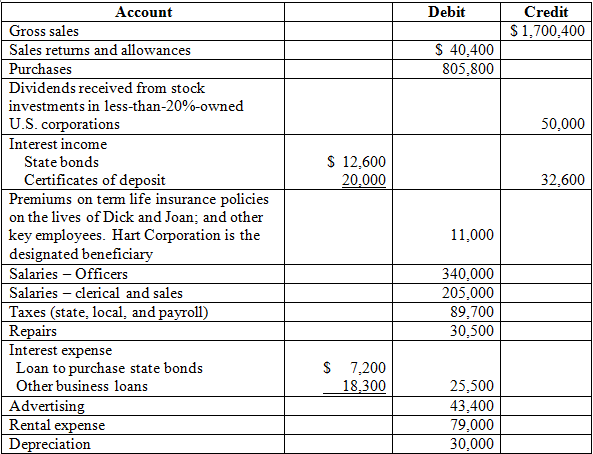

Selected portions of Hart?s profit and loss statement for 2014 reflect the following debits and credits:

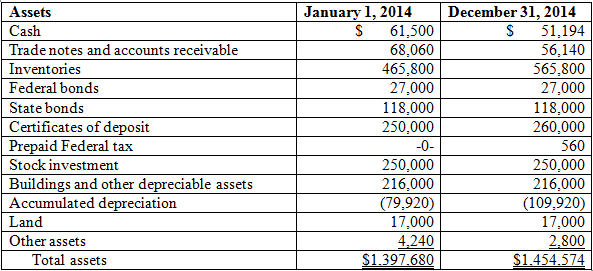

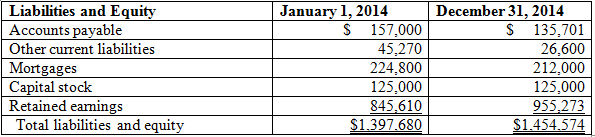

A comparative balance sheet for Hart Corporation reveals the following:

Net income per books (before any income tax accrual) is $182,700. During 2014, Hart Corporation made estimated tax payments of $43,597 to the IRS.

Note, Schedule L of Form 1120 reflects the book not tax balance sheet. None of the adjustments below should be entered into Schedule L.

Additional Information

You have been asked to review the financial data prepared by the Corporation's accountant and to prepare the Corporation's 2014 tax return. After reviewing the information presented you discover the following issues:

1. The corporation uses the accrual method to record all of its transactions. Last year, 2013, the corporation had collected rent in advance in the amount of $55,000 and recorded it as unearned income. This year the corporation receives $50,000 of advance rent and also records it as unearned income. All rental income was included in the gross sales of the Corporation.

2. For financial statements the corporation used the straight-line method of depreciation. For tax purposes they use MACRS. MACRS depreciation for the year is calculated to be $41,000.

3. Bad debt expense was recorded in cost of goods sold in the amount of $22,000. You determine that the Corporation is using a valuation method for recording bad debt. By analysis, you ascertain that actual bad debt expense for the year amounted to $25,000.

4. The corporation had several transactions related to corporate investments. All capital transactions were recorded in the gross sales account. Total capital gains were $20,000 and total capital losses were $29,000.

5. Included in the taxes account was interest expense for $3,000 due to an underpayment of taxes, and a late filing penalty payment of $700.

6. Although the financial records indicate a cash dividend of $30,000, you determine that the actual cash dividend amounted to $10,000. The remainder of the dividend consisted of depreciate property (equipment) with a fair market value of $20,000 and an adjusted basis of $9,000. The original cost of the depreciated property was $25,000.

7. In cost of goods sold you discover there are $12,000 of meals and entertainment expenses. Of the total M&E expense, $3,000 was for an annual company party on the 4th of July.

Account Gross sales Sales returns and allowances Purchases Dividends received from stock investments in less-than-20%-owned U.S. corporations Interest income State bonds Certificates of deposit Premiums on term life insurance policies on the lives of Dick and Joan; and other key employees. Hart Corporation is the designated beneficiary Salaries - Officers Salaries clerical and sales Taxes (state, local, and payroll) Repairs Interest expense Loan to purchase state bonds Other business loans Advertising Rental expense Depreciation $ 12,600 20,000 $ 7,200 18,300 Debit $ 40,400 805,800 11,000 340,000 205,000 89,700 30,500 25,500 43,400 79,000 30,000 Credit $ 1,700,400 50,000 32,600 Assets Cash Trade notes and accounts receivable Inventories Federal bonds State bonds Certificates of deposit Prepaid Federal tax Stock investment Buildings and other depreciable assets Accumulated depreciation Land Other assets Total assets January 1, 2014 S 61,500 68,060 465,800 27,000 118,000 250,000 -0- 250,000 216,000 (79,920) 17,000 4,240 $1.397.680 December 31, 2014 S 51,194 56,140 565,800 27,000 118,000 260,000 560 250,000 216,000 (109,920) 17,000 2,800 $1.454.574 Liabilities and Equity Accounts payable Other current liabilities Mortgages Capital stock Retained earnings Total liabilities and equity January 1, 2014 S 157,000 45,270 224,800 125,000 845,610 $1.397.680 December 31, 2014 $ 135,701 26,600 212,000 125,000 955,273 $1.454.574

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The Rental income received in advance should not form part of gross sales of that year but it shou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started