On March 1, 2017, Quinto Mining lnc. Issued a $560,000, 6%, three-year bond. Interest is payable semiannually beginning September 1, 2017. Required: Part 1 a.

On March 1, 2017, Quinto Mining lnc. Issued a $560,000, 6%, three-year bond. Interest is payable semiannually beginning September 1, 2017.

Required:

Part 1

a. Calculate the bond issue price assuming a market interest rate of 5% on the date of issue. (Do not round intermediate calculations. (Round the intermediate calculations. Round the final answer to nearest whole dollar.)

![]()

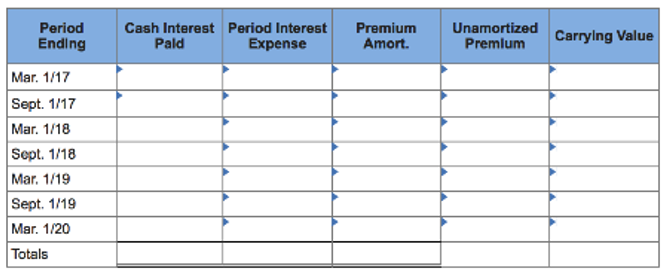

b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amounts as positive value.)

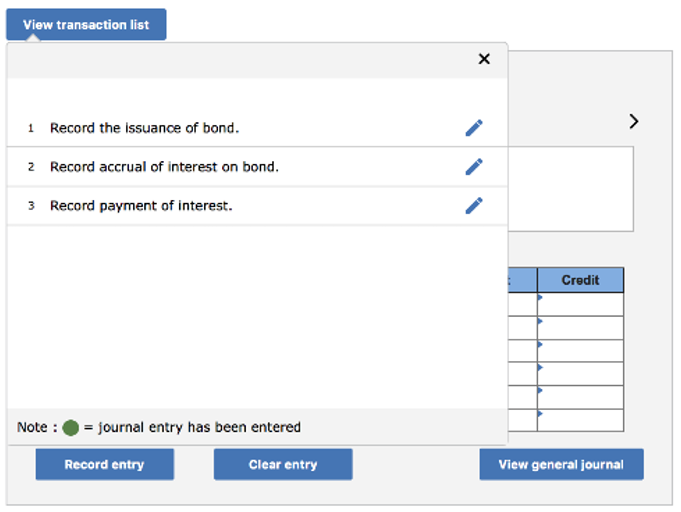

c. Round the entries for the issuance of the bond on March 1, the adjusting entry to accrue bond interest and related amortization or on April 30, 2017, Quinto?s year-end, and the payment of interest on September 1, 2017. (Do not round intermediate calculations. Round the final answers to nearest whole dollar.)

Part 2

a. Calculate the bond issue price assuming a market interest rate of 7.0% on the date of issue. (Do not round intermediate calculations. Round the final answer to nearest whole dollar.)

![]()

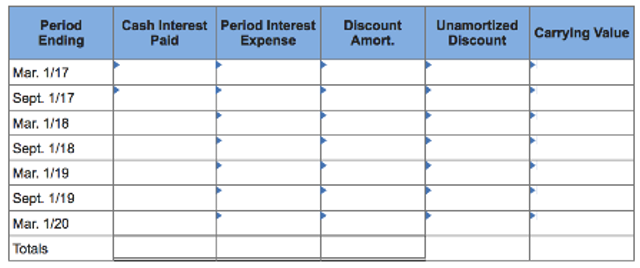

b. Using the effective interest method. [re[are am amortization schedule. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amount as positive values.)

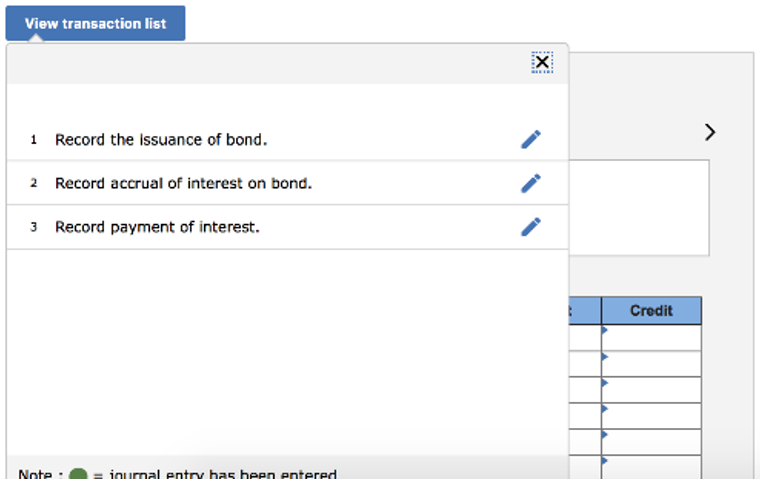

c. Round the entries for the issuance of the bond on March 1: the adjusting entry to accure bond interest and related amortization on April 30, 2017. Quinto?s year-end: and the payment of interest on September 1, 2017.

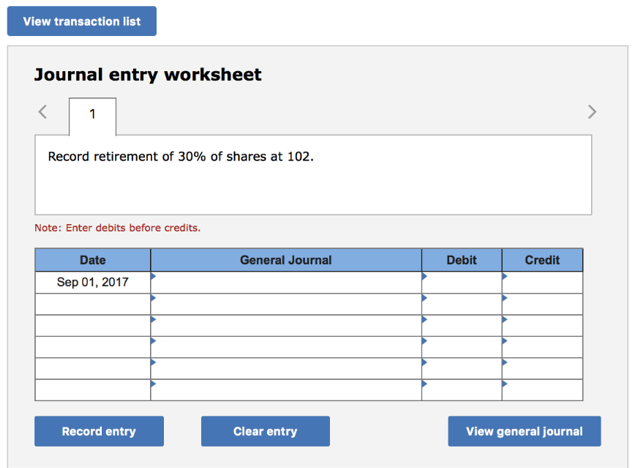

d. Round the entries for the retirement of 30% of the bonds at 102, on September 1, 2017, after the interest payment.

Total issue price Period Ending Mar. 1/17 Sept. 1/17 Mar. 1/18 Sept. 1/18 Mar. 1/19 Sept. 1/19 Mar. 1/20 Totals Cash Interest Period Interest Expense Pald Premium Amort. Unamortized Premium Carrying Value View transaction list 1 Record the issuance of bond. 2 Record accrual of interest on bond. 3 Record payment of interest. Note : = journal entry has been entered Record entry Clear entry X Credit View general journal > Total issue price Period Ending Mar. 1/17 Sept. 1/17 Mar. 1/18 Sept. 1/18 Mar. 1/19 Sept. 1/19 Mar. 1/20 Totals Cash Interest Paid Period Interest Expense Discount Amort. Unamortized Discount Carrying Value View transaction list 1 Record the issuance of bond. 2 Record accrual of interest on bond. 3 Record payment of interest. Note 11 inurnal entry has been entered X MIR Credit > View transaction list Journal entry worksheet 1 Record retirement of 30% of shares at 102. Note: Enter debits before credits. Date Sep 01, 2017 Record entry General Journal Clear entry Debit Credit View general journal

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started