Question

One of the worlds largest oil spills began on April 20, 2010, in BP's Deep water Horizon/Macondo well in the Gulf Of Mexico. Although the

One of the worlds largest oil spills began on April 20, 2010, in BP's Deep water Horizon/Macondo well in the Gulf Of Mexico. Although the world did not take significant notice until the next day, an estimated 62.000 barrels of oil and gas escaped into the Gulf for most of the next 95 days until the well was capped on July 27th. Damage to the Gulf Coast fishery, tourism and quality of life was catastrophic.

At first. BP estimated that the cost of cleanup alone would be 53-6 billion and set aside a claims fund of 520 billion .2 On July 27th BP set aside 532 2 billion to settle claims for loss of income. and cleanup and other costs. Later BP decided to raise their estimate to $30 billion, but even that may prove not to be enough.

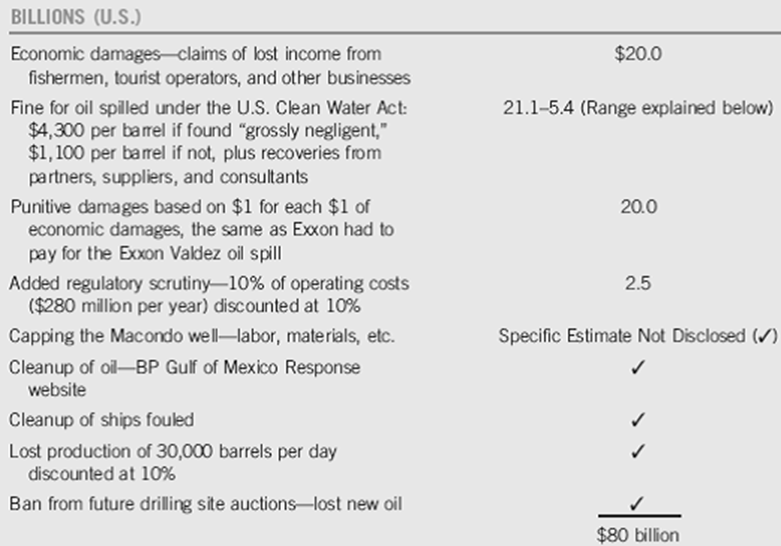

On December 1. 2010, Reuters published a -Special Report' that suggested BP's costs could rise to twice BP's final estimate?all the way TO 580 billion. Their estimates are noted in Table 1.

Reuters' estimates included several uncertainties. For some, Reuters included

Reuters' estimates of BP?s Gulf Oil spill Costs

a range of outcomes, for others they simply stated their existence. Some uncertainties will take time to clarify, such as: (1) how many of the claimants of lost revenue or income can prove the basis of their claim since they may not have paid taxes on all the revenue they earned, or (2) the future price of a barrel of oil. However, reasonable guesstimates or assumptions can be made that can contribute to a useful overall estimate. Some matters require ultimate clarification by court judgment or political decision because current opinions conflict. For example, if BP, the project operator, is judged as "grossly negligent" then BP would be liable for a fine of $4,300 per barrel spilled rather than $1,100 per barrel, and BP's partners-Anadarko Petroleum (25%) and Japan's Mitsui (10%)-would not have to pay any fines and cleanup costs. In addition, companies like those hired to drill (Transocean) and provide consulting advice (Haliburton) could also be off the hook. It would appear, however, that the White House Oil Spill Commission5 did not find direct evidence that BP's senior management had been reckless and therefore grossly negligent. They found no direct evidence of a "conscious decision to favor dollars over safety" which suggested instead that the tragedy could be characterized as ?a mistake by a low-level worker.' On the other hand, the Commission's cochairmen indicated that BP had "a culture that did not promote safety" and that their report "did not mean anyone was off the hook.? Rumors were also reported of a potential political deal to lower the fine from $4,300 per barrel. Biological uncertainties also need clarification. Various reports indicate the disappearance of the oil spilled, perhaps due to the actions of microbes in the warm water. Not surprisingly, there are opposing reports of finding oil spilled that has sunk deep into the ocean.

Time will make all uncertainties clearer, but estimates of potential costs are needed long before perfectly certain figures are available. In this regard, Reuters' estimate of the out-of-pocket impact on BP of the Deepwater Horizon/Macondo well disaster is quite useful for investors, employees, and auditors. But Reuters would be quite ready to admit that there are costs borne by other stakeholders that they have not included.

Oil Spill Video See http://Www.bp.com/sectiongenericarticle .do?categoryld=9033572&contentld=7061710.

What are beyond those that Reuters included? How would these costs be estimated?BILLIONS (U.S.) Economic damages-claims of lost income from fishermen, tourist operators, and other businesses Fine for oil spilled under the U.S. Clean Water Act: $4,300 per barrel if found "grossly negligent," $1,100 per barrel if not, plus recoveries from partners, suppliers, and consultants Punitive damages based on $1 for each $1 of economic damages, the same as Exxon had to pay for the Exxon Valdez oil spill Added regulatory scrutiny-10% of operating costs ($280 million per year) discounted at 10% Capping the Macondo well-labor, materials, etc. Cleanup of oil-BP Gulf of Mexico Response website Cleanup of ships fouled Lost production of 30,000 barrels per day discounted at 10% Ban from future drilling site auctions-lost new oil $20.0 21.1-5.4 (Range explained below) 20.0 2.5 Specific Estimate Not Disclosed () $80 billion

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

RS estimate of the Gulf Oil Spill Costs includes Economic damages ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6099ba54a8d73_29970.pdf

180 KBs PDF File

6099ba54a8d73_29970.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started