Question

Part A When the auditor conducts substantive tests each side of the journal entry is affected, i.e. double entry accounting. For each of the following

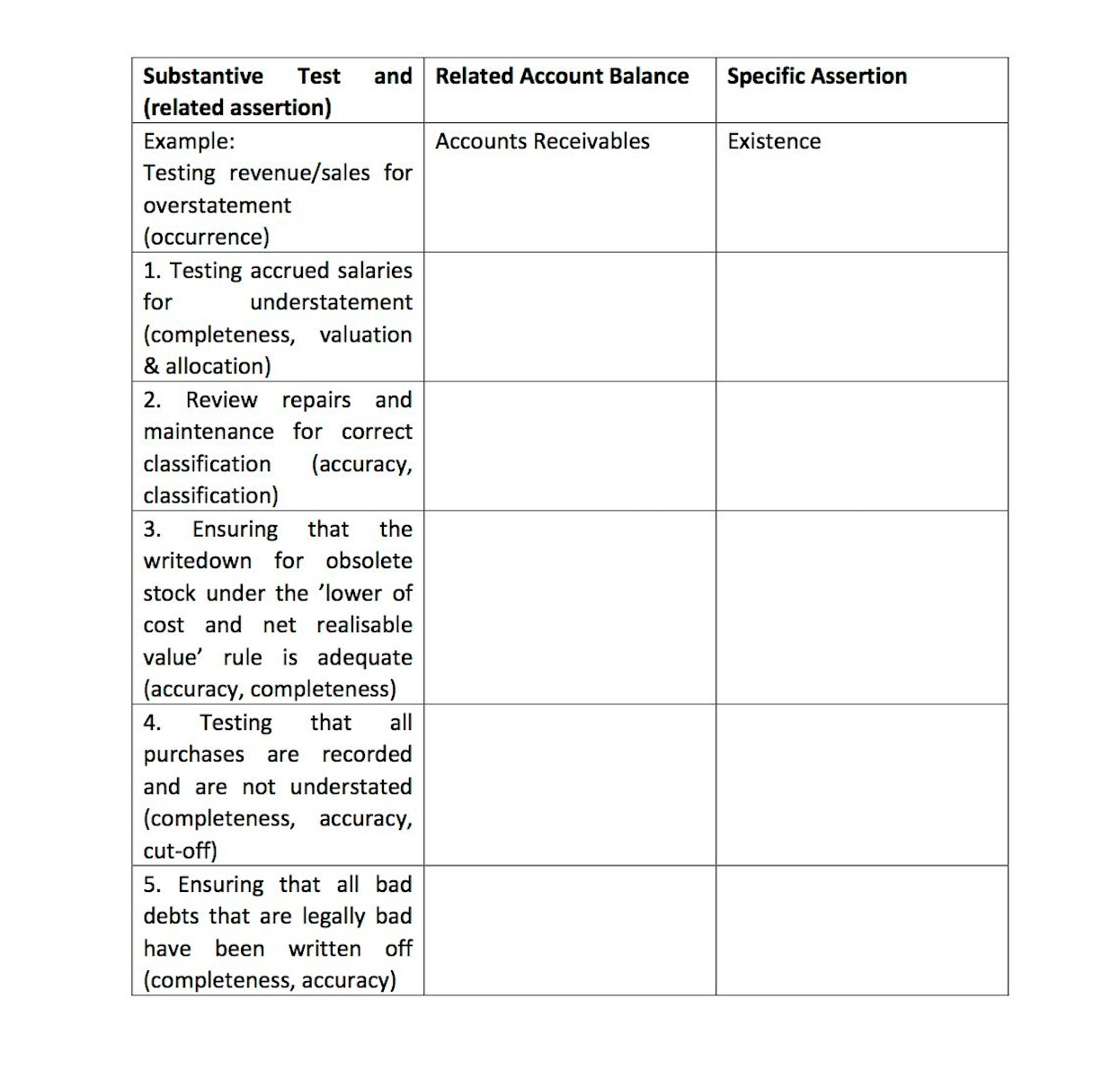

Part A When the auditor conducts substantive tests each side of the journal entry is affected, i.e. double entry accounting. For each of the following substantive tests, (and related assertion) indicate one other account, and one specific assertion relating to that account, for which evidence is also being provided. Substantive Test and (related assertion) Related Account Balance Specific Assertion Example:

Part B

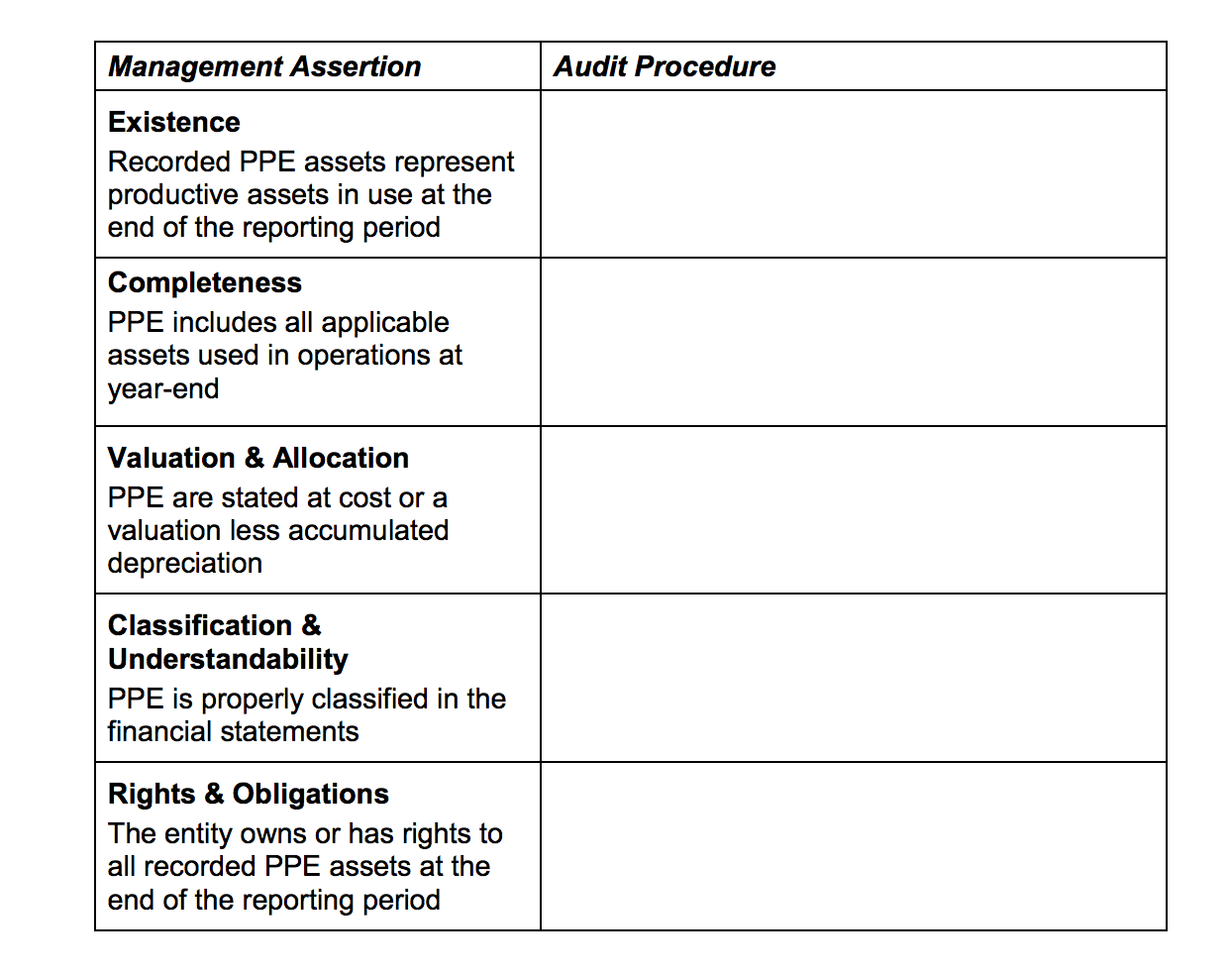

Your firm is auditing Rainbow Paints Ltd, a large manufacturer of painting products. You have been assigned the audit of property, plant and equipment (PPE) for the year ended 30 June 2014.

Rainbow Paints Ltd maintains a computerized fixed assets register. The company has three main classes of PPE: (1) Freehold Land & Buildings, (2) Manufacturing Machinery, Plant & Equipment, and (3) Motor Vehicles.

You are concerned that the depreciation rates for Motor Vehicles may be inadequate. You are also concerned that the recent revaluation of Freehold Land and Buildings by 20% is too high in the current economic climate.

Required:

For each management assertion listed in the table below, provide one substantive audit procedure specifically in relation to one of the above PPE accounts that would be used to gather sufficient appropriate audit evidence.

Substantive Test and Related Account Balance (related assertion) Example: Testing revenue/sales for overstatement (occurrence) 1. Testing accrued salaries for understatement (completeness, valuation & allocation) 2. Review repairs and maintenance for correct classification (accuracy, classification) 3. Ensuring that the writedown for obsolete stock under the 'lower of cost and net realisable value' rule is adequate (accuracy, completeness) 4. Testing that all purchases are recorded and are not understated (completeness, accuracy, cut-off) 5. Ensuring that all bad debts that are legally bad have been written off (completeness, accuracy) Accounts Receivables Specific Assertion Existence Management Assertion Existence Recorded PPE assets represent productive assets in use at the end of the reporting period Completeness PPE includes all applicable assets used in operations at year-end Valuation & Allocation PPE are stated at cost or a valuation less accumulated depreciation Classification & Understandability PPE is properly classified in the financial statements Rights & Obligations The entity owns or has rights to all recorded PPE assets at the end of the reporting period Audit Procedure

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Testing accrued salaries for understatement Indirect Expenses Account Accuracy 2 Review repairs an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60910b166cf1b_22091.pdf

180 KBs PDF File

60910b166cf1b_22091.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started