Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phil Williams and Liz Johnson are 60% and 40% partners, respectively, in Williams & Johnson Partnership, Their beginning basis is $33,000 for Phil and $31,000

Phil Williams and Liz Johnson are 60% and 40% partners, respectively, in Williams & Johnson

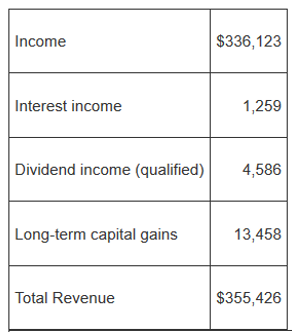

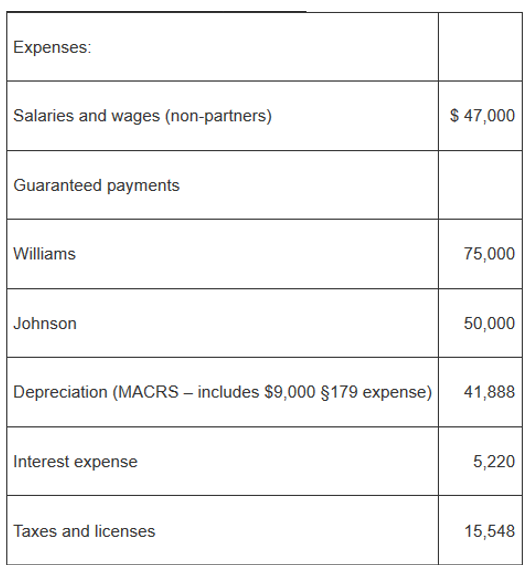

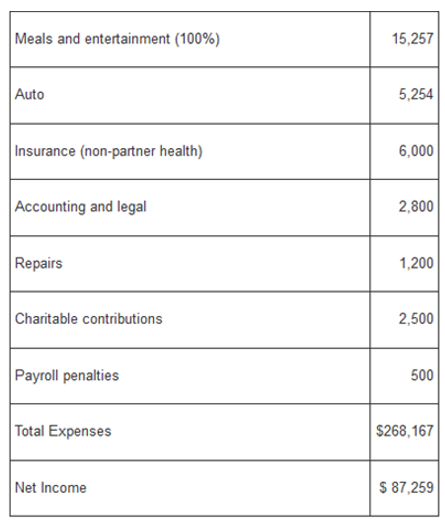

Partnership, Their beginning basis is $33,000 for Phil and $31,000 for Liz. The partnership had the following activity during the year:

a. Calculate the ordinary income for the partnership and prepare page 1 of Form 1065.

b. What is the ending basis for Phil Williams?

c. What is the ending basis for Liz Johnson?

Income Interest income Dividend income (qualified) Long-term capital gains Total Revenue $336,123 1,259 4,586 13,458 $355,426 Expenses: Salaries and wages (non-partners) Guaranteed payments Williams Johnson Depreciation (MACRS-includes $9,000 $179 expense) Interest expense Taxes and licenses $ 47,000 75,000 50,000 41,888 5,220 15,548 Meals and entertainment (100%) Auto Insurance (non-partner health) Accounting and legal Repairs Charitable contributions Payroll penalties Total Expenses Net Income 15,257 5,254 6,000 2,800 1,200 2,500 500 $268,167 $ 87,259

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609505ae01061_25469.pdf

180 KBs PDF File

609505ae01061_25469.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started