Question

Prepare a Master Budget which includes the following: 1) Sales Budget 2) Production Budget 3) Direct Materials Purchases Budget 4) Direct Labor Cost Budget All

Prepare a Master Budget which includes the following:

1) Sales Budget

2) Production Budget

3) Direct Materials Purchases Budget

4) Direct Labor Cost Budget

All budgets should be for the individual three (3) months of the first quarter of 2017.

Show your work (calculations) for each budget.

The selling price per unit has remained constant for the past year and is expected to remain unchanged throughout the first quarter of 2017 at an amount of $68.99

Total sales consist of the following:

Cash sales?????????????????5%

Credit sales????????????????.95%

Credit collections are as follows:

In the month following the month of sale????..75%

In the second month following the month of sale?..25%

The Company does not have any bad debts.

1. The Company's policy is to produce during each month, enough units to meet the current month's sales as well as a desired inventory at the end of the month which should be equal to 23% of next month's estimated sales. On December 31, 2016, the finished goods inventory consisted of 1,714 units at a cost of $50.40.

2. Each month the Company purchases enough direct materials to meet that month's production requirements and an amount equal to 25% of the next month's estimated production requirements. Each unit of finished product requires 2.83 pounds of direct materials at a cost of $1.38 per pound. On December 31, 2016, the direct materials inventory consisted of 5,213 lbs. at a cost of $1.38.

Payments are made as follows:

In the month of purchase??????????80%

In the following month the balance??????20%

The accounts payable balance of $5,755.15 as of December 31, 2016, represents 20% of purchases made in December 2016 to be paid in January 2017.

3. Direct labor hours required per unit of finished product????..1.75

Average rate per direct labor hour??????????????$12.25

4. The Company applies variable factory overhead cost at the rate of 120% of direct labor cost and fixed factory overhead on the basis of the number of direct labor hours.

The company has the following fixed overhead expenses per month:

Factory supervisor's salary????????..$54,000.00

Factory rent??????????????6,000.00

Factory insurance????????????6,500.00

Depreciation of factory equipment?????.600.00

All factory overhead costs, except depreciation, are paid for in cash during the month in which they are incurred.

5. Selling and Administrative Expenses

Variable selling expenses are:

Freight out?????????????.$0.80 per unit

Sales commissions??????????1% of sales

Fixed selling and administrative expenses per month are:

Salaries?????????$8,700.00

Rent??????????1,800.00

Advertising???????.150.00

Insurance????????.250.00

Depreciation (excluding depreciation of computer to be

purchased at the end of January 2017??????????10,050.00

6. Combined tax rate is 30% of Income before taxes computed at the end of the quarter ending March 31, 2017 , payable in the second quarter.

7. The Company expects to buy a new computer on January 31, 2017, for use in the sales and administrative offices at a cost of $180,000.00, which will be paid in cash. Monthly depreciation expense will be an additional $3,000.00.

8. On March 31, 2017, the Company is scheduled to pay $300,000.00 , of the long-term notes payable plus interest expense for the first quarter at a rate of 12%

With respect to short-term borrowing, the Company's policy is to borrow at the beginning of a month with an anticipated cash deficiency. A minimum cash balance of $25,000.00 is required of the end of each month. The Company repays the principal of such short-term borrowing at the end of the first following month to the extent of anticipated excess cash. Interest must be paid the following month at a rate of 12%. Borrowing and principal repayments are made in multiples of $1,000.00.

9. Investments earn interest of the rate of 6% per annum which is credited to our Checking account by the bank at the beginning of the following month. You may assume that the balance of Marketable Securities at December 31, 2016, was outstanding throughout the entire month.

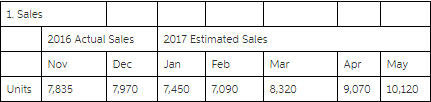

1. Sales 2016 Actual Sales Dec Nov Units 7,835 7,970 2017 Estimated Sales Jan 7,450 7,090 Feb Mar 8,320 Apr 9,070 May 10,120

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Sales budget Jan Feb March Quarter Units 7450 7090 8320 22860 Per unit price 6899 6899 6899 6899 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6091a3de38e48_22490.pdf

180 KBs PDF File

6091a3de38e48_22490.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started