Answered step by step

Verified Expert Solution

Question

1 Approved Answer

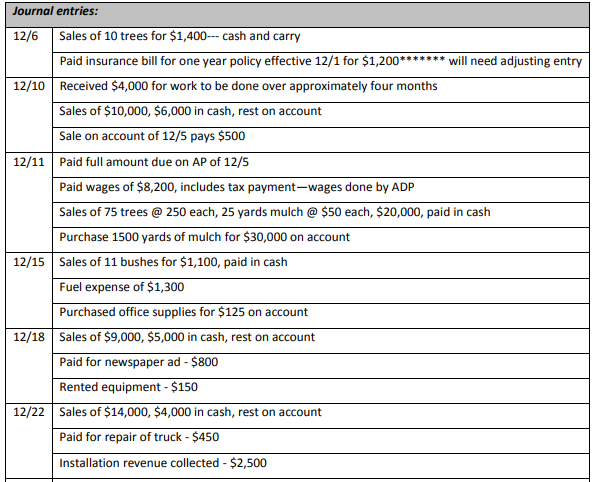

Prepare journal entries of following events and correctly arrange the journal entries. Journal entries: 12/6 Sales of 10 trees for $1,400--- cash and carry Paid

Prepare journal entries of following events and correctly arrange the journal entries.

![]()

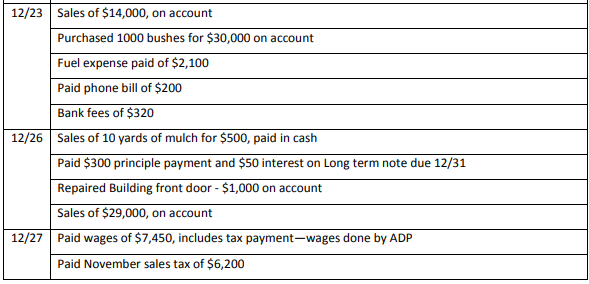

Journal entries: 12/6 Sales of 10 trees for $1,400--- cash and carry Paid insurance bill for one year policy effective 12/1 for $1,200***** 12/10 Received $4,000 for work to be done over approximately four months Sales of $10,000, $6,000 in cash, rest on account Sale on account of 12/5 pays $500 12/11 Paid full amount due on AP of 12/5 ***** will need adjusting entry Paid wages of $8,200, includes tax payment-wages done by ADP Sales of 75 trees @ 250 each, 25 yards mulch @ $50 each, $20,000, paid in cash Purchase 1500 yards of mulch for $30,000 on account 12/15 Sales of 11 bushes for $1,100, paid in cash Fuel expense of $1,300 Purchased office supplies for $125 on account 12/18 Sales of $9,000, $5,000 in cash, rest on account Paid for newspaper ad - $800 Rented equipment - $150 12/22 Sales of $14,000, $4,000 in cash, rest on account Paid for repair of truck - $450 Installation revenue collected - $2,500 12/23 Sales of $14,000, on account Purchased 1000 bushes for $30,000 on account Fuel expense paid of $2,100 Paid phone bill of $200 Bank fees of $320 12/26 Sales of 10 yards of mulch for $500, paid in cash Paid $300 principle payment and $50 interest on Long term note due 12/31 Repaired Building front door - $1,000 on account Sales of $29,000, on account 12/27 Paid wages of $7,450, includes tax payment-wages done by ADP Paid November sales tax of $6,200 Installation revenue paid - $2,500

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Journal DATE ACCOUNTS AND EXPLANATIONS POST DEBIT CREDI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started