Question

Pretty Gone Ltd commenced operations on 1 July 2015. Extracts from the statements of financial position of Pretty Gone Ltd as at 30 June 2017

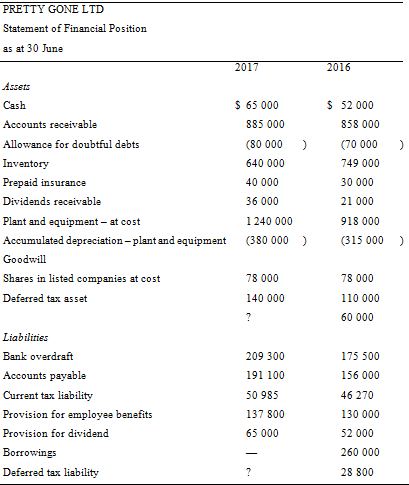

Pretty Gone Ltd commenced operations on 1 July 2015. Extracts from the statements of financial position of Pretty Gone Ltd as at 30 June 2017 and 30 June 2016 are as follows:

Additional information

? Accumulated depreciation based on tax depreciation is $485 000 at 30 June 2017and $360 000 at 30 June 2016. There have been no disposals of plant during the year to 30 June 2017.

? Deferred tax liabilities and assets are not netted off in the statement of financial position.

? The corporate tax rate is 30%.

A. Prepare the deferred tax worksheet at 30 June 2016 to prove that the deferred tax liability and asset balances are $28 800 and $60 000 respectively.

B. Prepare the deferred tax worksheet at 30 June 2017 to determine the deferred tax entries for the year.

C. Assume that the company made a profit before tax of $700 000 for the year to 30 June 2017 and that the differences between accounting profit and taxable profit are apparent from items shown in the statement of financial position and its comparative. Prepare the condensed current tax worksheet for the year to 30 June 2017 and the current tax entries for the year.

PRETTY GONE LTD Statement of Financial Position as at 30 June Assets Cash Accounts receivable Allowance for doubtful debts Inventory Prepaid insurance Dividends receivable Plant and equipment - at cost Accumulated depreciation - plant and equipment Goodwill Shares in listed companies at cost Deferred tax asset Liabilities Bank overdraft Accounts payable Current tax liability Provision for employee benefits Provision for dividend Borrowings Deferred tax liability 2017 $ 65 000 885 000 (80 000 640 000 40 000 36 000 1 240 000 (380 000) 78 000 140 000 ? 209 300 191 100 50 985 137 800 65 000 ? ) 2016 $ 52 000 858 000 (70 000 749 000 30 000 21 000 918 000 (315 000 ) 78 000 110 000 60 000 ) 175 500 156 000 46 270 130 000 52 000 260 000 28 800

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Deferred Tax Worksheet As at 30 June 2016 Carrying Amount Deductible Amount Tax Base Taxable Temp ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started