Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Robert and Mary file a joint tax return for 2015 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000,

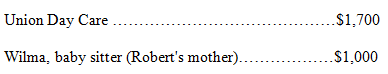

Robert and Mary file a joint tax return for 2015 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000, respectively, during 2015. In order for Mary to be gainfully employed, they pay the following child care expenses for their 4-year-old son, John:

What is the amount of the child and dependent care credit they should report on their tax return for 2015?

? $459

? $729

? $270

? $675

? None of these choices are correct.

Show transcribed image text

Union Day Care... Wilma, baby sitter (Robert's mother).. .$1,700 .....$1,000

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The amount of the child ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

608f65ed22515_21028.pdf

180 KBs PDF File

608f65ed22515_21028.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started