Rogers printing Ltd. Has contracts to complete weekly supplements required by it?s cutomers.For the current year, manufacturing overhead cost estimates total $ 580,000 for an

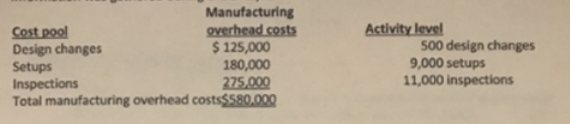

Rogers printing Ltd. Has contracts to complete weekly supplements required by it?s cutomers.For the current year, manufacturing overhead cost estimates total $ 580,000 for an annual production capacity of 14, 5000,000 pages. Currently overhead is allocated on a per page basis.Rogers printing is trying to decide if they should evaluate the use of additional cost pools. After analyzing manufacturing overhead cost, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

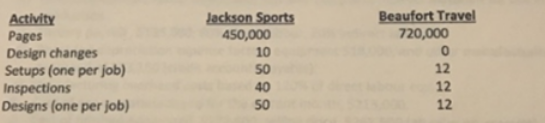

Two customers, Jackson Sports and Beaufort Travel, are expected to use the following printing services:

Pages are a direct cost at $0.02 per page. Design costs per job average $1,500 and $1,700 for Jackson Sports and Beaufort Travel, respectively. Rogers Printing sets prices at $0.11 per page.

Assume that all costs are variable/

Required:

- Calculate the manufacturing overhead allocation rate for each activity using ABC

- Compute the total cost for each customers using ABC

Manufacturing overhead costs $ 125,000 180,000 275,000 Total manufacturing overhead costs$580,000 Cost pool Design changes Setups Inspections Activity level 500 design changes 9,000 setups 11,000 inspections Activity Pages Design changes Setups (one per job) Inspections Designs (one per job) Jackson Sports 450,000 10 50 40 50 Beaufort Travel 720,000 12 12 12

Step by Step Solution

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 Cost Activitie level Overhead Allocation Rate Design Changes 125000 500 25000 Setu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

608ea664a88ae_20523.pdf

180 KBs PDF File

608ea664a88ae_20523.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started