Question

Seacera Tiles Corp is considering the following average risk projects for its next Seacera has 10,000 bonds outstanding that were issued for 30 years ten

Seacera Tiles Corp is considering the following average risk projects for its next

Seacera has 10,000 bonds outstanding that were issued for 30 years ten years ago at a par value of RM1,000.00 and a coupon rate of 12%, with interest paid semi-annually. Similar bonds are now selling to yield 9%. Tax rate is 40%.

It issued 40.000 shares of 6% preferred stock at an RM100.00 par value eight years ago.

Those preferred shares are now selling to yield 10%. and are subject to an 8% flotation cost.

There are currently 2.500.000 of common stock outstanding selling for RM11.60 a share.

Expected dividend to be paid is RM0.93 per share and dividends are expected to grow at the rate of 6%.

Develop Seacera's market value based capital structure, calculate its WACC. Assume equity capital comes from retained earnings. Based on the WACC estimates calculated, which projectis if any. would be selected and what is the total investmentis for the next planning period?

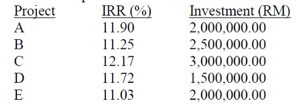

Project A B C D E IRR (%) 11.90 11.25 12.17 11.72 11.03 Investment (RM) 2,000,000.00 2,500,000.00 3,000,000.00 1,500,000.00 2,000,000.00

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The capital structure for Seacera would consist of three partsthree sources of capitalfinancing name...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started