Question

Supernova Company had the following summarized balance sheet on December 31, 20?1: The fair value of the inventory and property and plant is $600,000 and

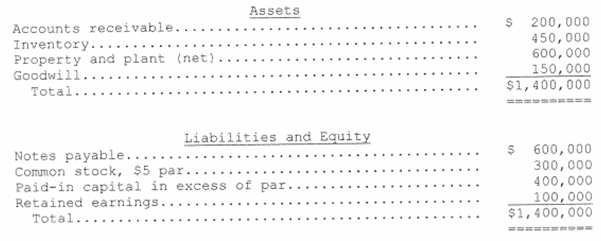

Supernova Company had the following summarized balance sheet on December 31, 20?1:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 45,000 of its $3 par value shares of common stock, when the fair price is $4/share, for 1008 of the common stock of Supernova Company. Redstar incurred indirect acquisition costs of $10,000.(100% purchase with Extraordinary Gain)

Required:

a. What journal entry will Redstar Corporation record for the investment in Supernova?

b. Prepare a supporting determination and distribution of excess schedule

c. Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Accounts receivable.. Inventory..... Property and plant (net) Goodwill.. Total... Assets Liabilities and Equity Notes payable.. Common stock, $5 par. Paid-in capital in excess of par. Retained earnings... Total.... 200,000 450,000 600,000 150,000 $1,400,000 $ == 600,000 300,000 400,000 100,000 $1,400,000 $

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Investment journal entry Date Account name Debit Credit Investment in Supernova 75000 20 1500000 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started